Highlights

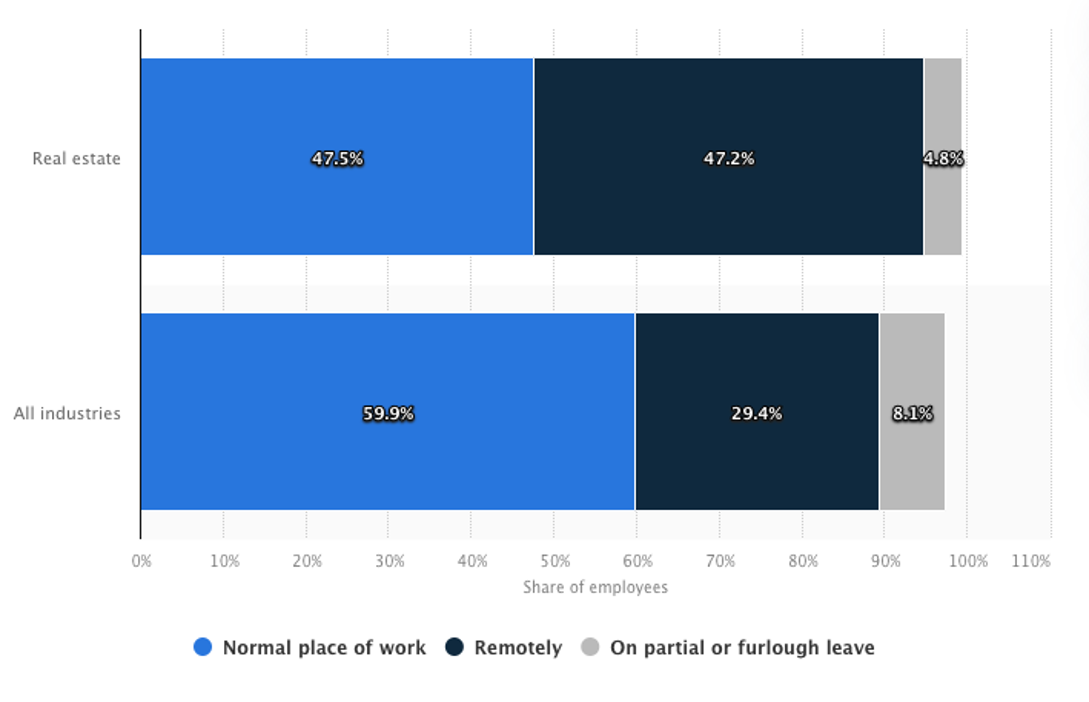

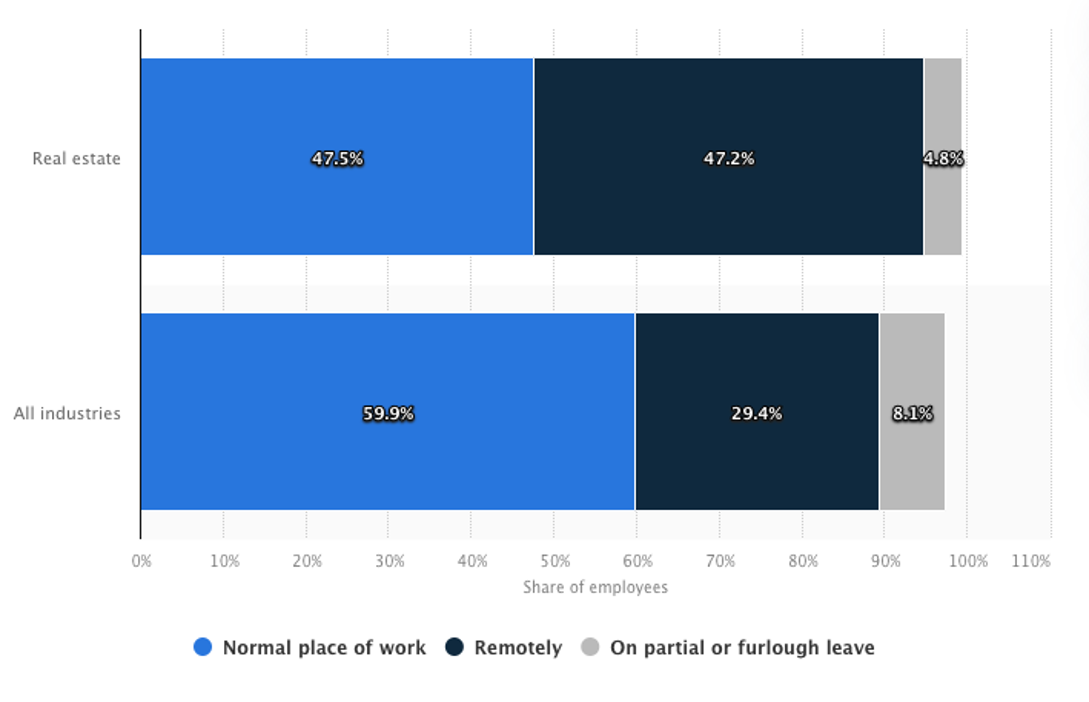

- According to a survey of nearly 9,400 businesses in the United Kingdom at the beginning of May 2021, real estate employees were less likely to go into partial or furlough leave than the average for all sectors in the United Kingdom (UK) as of May 2021. Additionally, they were more likely to work remotely. Approximately 47.2 per cent of the real estate workforce worked remotely instead of at their usual place of work, compared to 28.4 per cent of the UK workforce.

Source: Statista, 2021

- The property market is open and active throughout the UK, with estate agents conducting in-person house viewings and buyers moving home. Since last July, the UK property market has been on the rise, led by the government temporarily cutting stamp duty.

- The most significant savings of up to £15,000 ended on 30 June, but buyers in England and Northern Ireland could save up to £2,500 if they bought a home before the end of September.

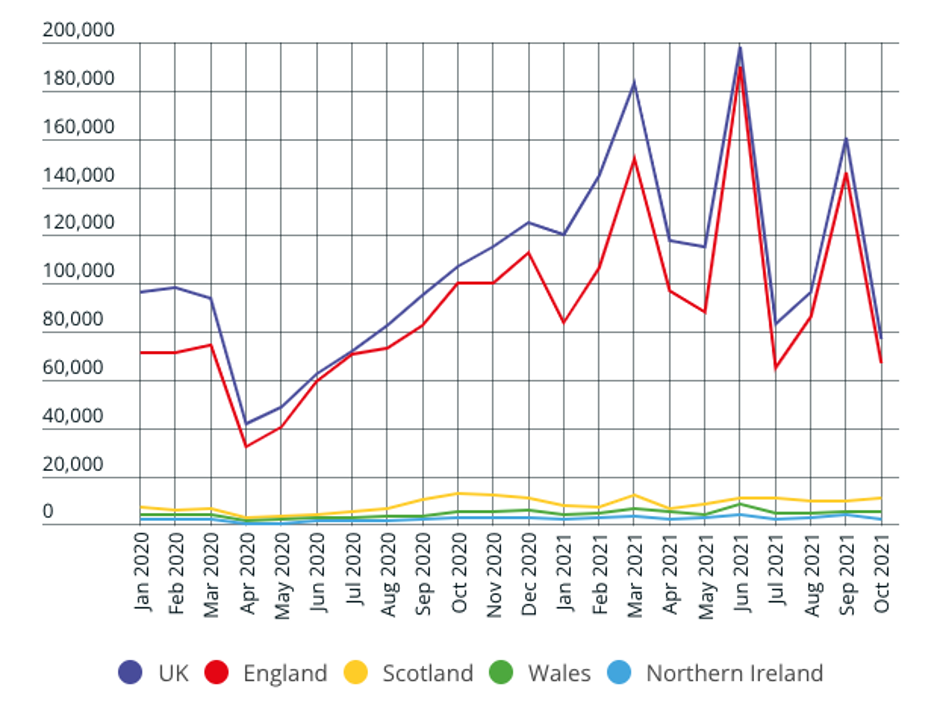

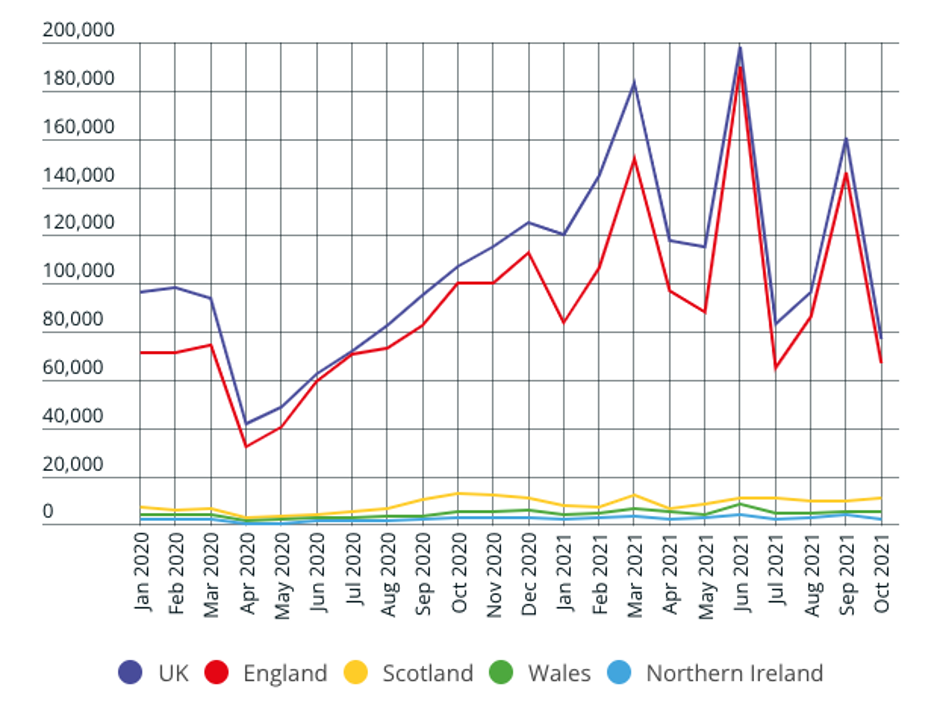

- The number of houses being sold rose significantly during the tax holiday, with peaks in June and September as buyers sought to get transactions over the line in time to save on tax.

- Provisional data from HM Revenue and Customs (HMRC) shows that just 76,930 sales went through in October, less than half the number recorded in September. The graph below shows the number of sales registered each month since the start of 2020:

Source: HMRC, 23 November 2021. Figures represent all residential property transactions of £40,000 or above. UK figures are seasonally adjusted; individual nations are not. Figures for August, September and October 2021 are provisional.

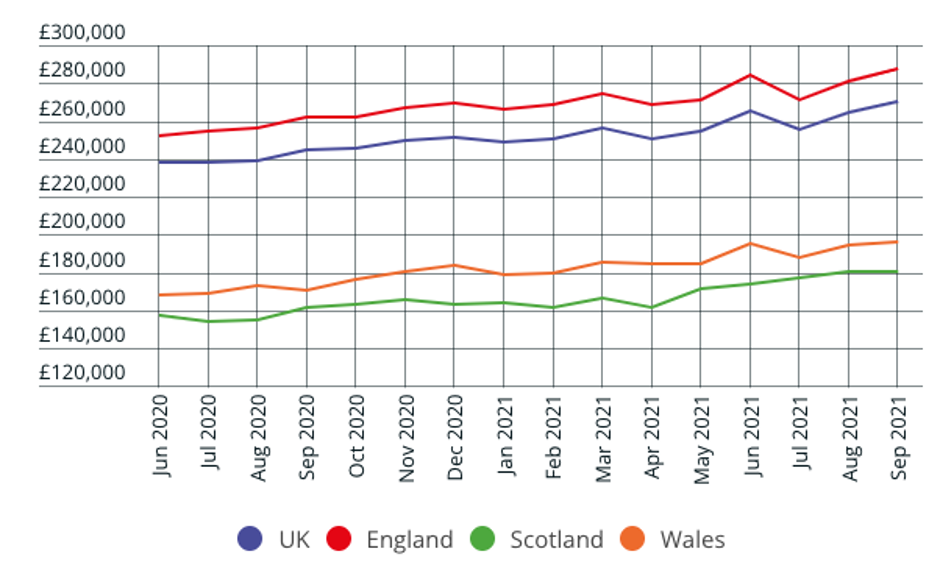

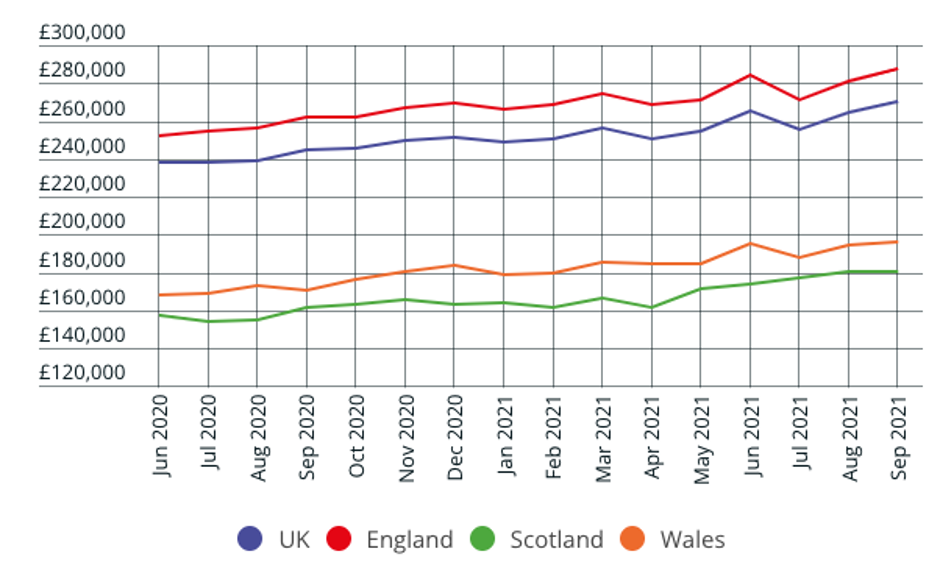

- The Land Registry says that the average price of a property in the UK rose by 11.8% year-on-year in September to reach £269,945, as shown in the graph below:

Source: UK House Price Index, 17 November 2021. Comparable data not available for N.Ireland. Average property price in Northern Ireland during Q3 of 2021 was £159,109.

- Nationwide’s index (based on mortgage lending) reported a 0.9% monthly and 10% annual rise in prices in November. Halifax’s index (also based on lending) reported a 0.9% monthly and 8.1% yearly increase in October.

- There’s been a great deal of optimism around the property market of late, with an imbalance between supply and demand, meaning properties are selling more quickly than before.

- Research by Rightmove found that the average time to agree on a sale in October was 36 days, the joint-lowest figure registered since the pandemic’s start.

October 2021

The latest Government announcements mean we are now living in a three-tier society.

‘Medium’ risk areas continue with the current national measures. ‘High’ risk areas will adopt stricter measures to curb household-to-household transmission. Many areas already have these restrictions in place, but local authorities will now apply the restrictions consistently.

As a minimum, restrictions in ‘Very High’ risk areas will:

- prohibit households from mixing indoors or outdoors

- apply the Rule of Six in public spaces

- make bars and pubs operate like a restaurant by only offering a seated meal service

Restrictions could extend to closing leisure facilities.

What does this mean for real estate? There are two positives. The Government has simplified the mess of local restrictions to three tiers. And the framework states that non-essential retail will remain open at all levels, as would offices and warehouses.

The shift from national to local restrictions is complete; however, the shift from national to local fiscal support is missing. This mismatch has already caused tension between central and local governments. Businesses in the ‘Very High’ tier will need more support to limit the short-term economic impact of the additional restrictions and give their respective real estate markets a chance to recover in line with the rest of the country. (Cushman & Wakefield, 2021)

September 2021

The job market is unrecognisable to how it looked only six months ago. More people are working, earnings are up in every sector, the claimant count has fallen, and productivity is up.

Moreover, companies are trying to hire at a record pace. Almost 840 thousand service sector jobs are available. In retail, hospitality, arts and entertainment there are 270 thousand vacancies. Filling them will kick-start the sectors’ recoveries, following their loss of 650 thousand jobs since the pandemic began. Meanwhile, health and social care, science and tech sectors have gained jobs during the pandemic and are looking for more recruits – companies need to fill over 300 thousand new roles. As for the other service sectors, a full recovery is possible if companies fill their current vacancies.

Friction in the labour market could reduce the polarisation the pandemic has caused. People with customer-facing experience will fill the available retail and leisure roles quickly. The difficulty will come in the healthcare and science sectors, which risk a skills shortage.

Given the pace of hiring, we should assume the lag from economic recovery to improved real estate demand is shorter than usual. Companies have already made the call that they need to grow. Many are growing beyond their pre-Covid levels, and the health, science and tech sectors are leading. (Cushman & Wakefield, 2021)

Covid-19 Impact

- Industry revenue declined in 2020-21, partly due to falling demand from the non-residential property market due to the coronavirus outbreak. Stringent social distancing measures enforced between 23 March 2020 and July 2021 led to the temporary closure of non-essential businesses; many commercial operations such as offices were forced to close where necessary or opted to shut while employees worked from home.

- Social distancing and stay-at-home measures in response to the coronavirus pandemic weighed on industry revenue in 2020-21, as a significant number of residential and non-residential tenants renegotiated lease agreements or terminated contracts entirely to save on costs while commercial facilities such as offices were not fully operational.

- The coronavirus pandemic reduced demand from residential property markets, as tenants across the country moved in with family members due to working from home or fears of losing their jobs. According to figures released by personal finance comparison organisation Finder, as of June 2020, approximately 10.5 million Britons had moved back in with their parents due to the coronavirus crisis. (IBIS World, 2021)[1]

Predictions

- The estate agency Savills predicts prices will rise by 3.5% in 2022 and 3% in 2023. The property portal Zoopla has similar projections. It indicates a 3% increase in 2022, with 1.2 million house purchases going through.

- Lifestyle changes are still prevalent, and buyers are now looking to a very different future from the one they envisioned two years ago. The search for green space, home offices and more flexible living is a trend that is unlikely to diminish before the new year.

- Advisors and investors are forecasting a little more strongly for pay rises, with 15% and 6% respectively budgeting for salary increases of at least 6%. On the other hand, developers are a lot more cautious regarding salaries, with respondents in this market split evenly across the 0%, 0-3% and 3-6% increase options. (Mc Donald and Company, 2021)

- A year of little to no business activity does affect salary budgets. Not surprisingly, businesses may need to wait to see how the market picks up, and business increases before committing to salary increases. (Mc Donald and Company, 2021)

Use of Technology

- During last year’s lockdown, estate agents began offering video house viewings, and these are continuing to play a part despite the recent lifting of restrictions.

- The government’s latest guidance recommends that buyers ‘take advantage of any opportunities to view homes remotely before committing to view in person.’