Farmers are responding to a dynamic situation involving unique circumstances in unprecedented economic conditions. The entire foodservice sector (including the supply of produce to restaurants and coffee shops) was effectively shut down overnight. This has particularly affected several farming sectors, most notably the dairy and meat sectors, where the demand for prime beef cuts has fallen.

This, combined with new buying habits and shopping timings (with consumers no longer buying food at the weekend and furloughed workers shopping on different days of the week), has put a massive strain on the short supply chain.

Supermarkets have found it hard to predict, adapt and respond to changes in shopping habits. Farmers at the end of the supply chain have been left with no option in some cases other than to dispose of produce, despite increased demand.

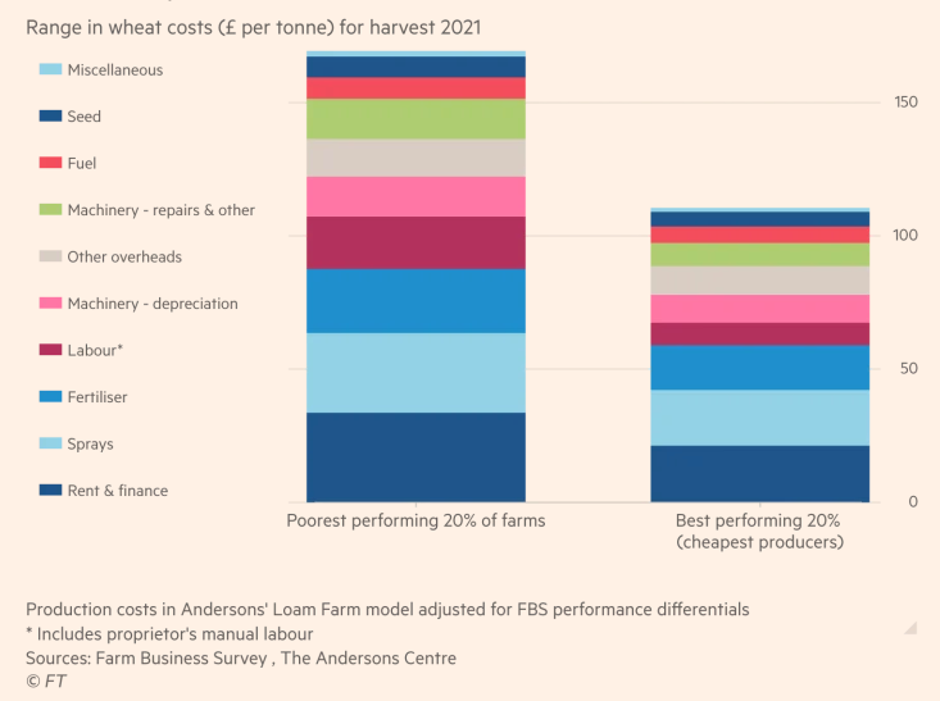

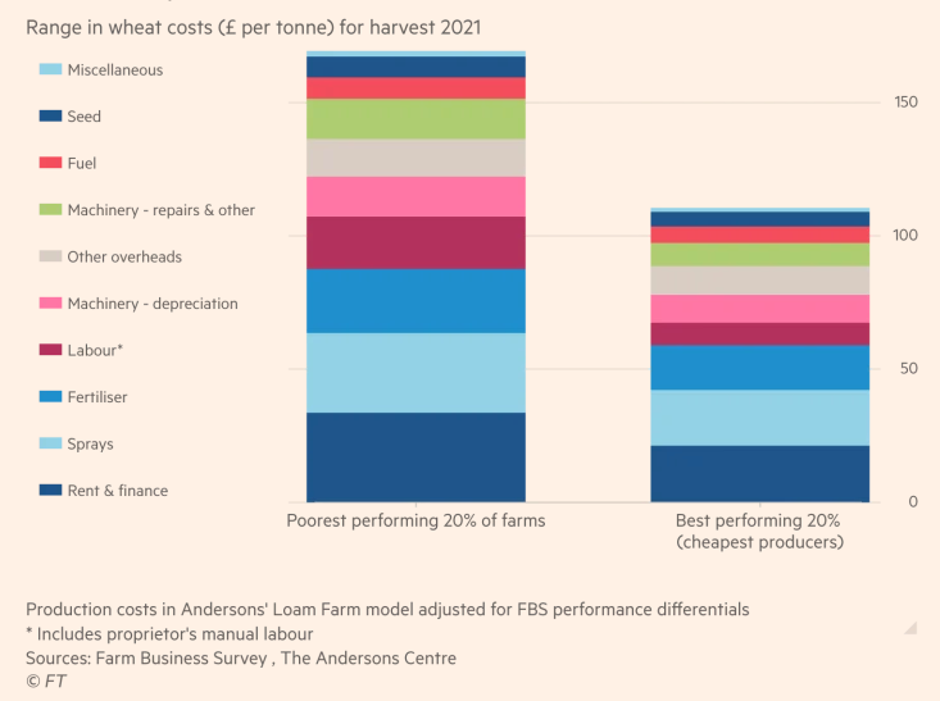

Scope for reductions in fixed costs

Labour and power costs on arable farms, on average £420-£440 per hectare, will have to be reduced to below £340 to be profitable. Research by the farming consultancy The Andersons Centre (see chart below) suggests how fixed costs could be pruned back, with significant implications for the agricultural labour market. (The Andersons Centre, 2021)

Source: The Andersons Centre

The Horticultural Trades Association (HTA) has been hard hit, with the government imposing mandatory measures closing businesses at the peak time for selling annual products. The HTA is calling on the government for financial assistance of up to £250 million to help the horticulture industry avoid collapse (see Legal update, COVID-19: The Horticultural Trades Association is asking the government for financial assistance of up to £250 million to help the industry avoid collapse).

Potato growers were left holding thousands of tonnes of potatoes in stores previously destined for the fish and chip trade, with an estimated 200,000 tonnes of potatoes in stock.

The spread of COVID-19 has caused severe difficulties for many businesses in the UK’s dairy sector, which has been severely affected by the impact on the entertainment food industry.

Farmers sell most of their milk to processors under a contract. A processor will typically supply a specific consumer-facing sector (for example, hospitality or retail). Dairy traders operate within the supply chain to buy and sell milk, and logistic services providers transport or store milk or milk products. The hospitality sector’s recent downturn, which has resulted from businesses closing to prevent the spread of COVID-19 in the UK, has reduced demand for dairy products. As a result, producers who service demand from the hospitality sector face a significant over-supply of raw milk, a perishable product with a short shelf life.

According to the Royal Association of British Dairy Farmers, over 1 million litres of milk have been “poured down the drain” due to COVID-19. The cost of disposing of this milk responsibly has resulted in additional expenses to farmers. This increases disposal costs without profit, so milk is being produced at a loss.

Within dairy produce, the demand for certain dairy products has also varied. For example, the demand for cheddar cheese for use in home cooking has increased, while products such as stilton or cheeses used in restaurants or home entertainment have declined.

There is limited capacity for processing raw milk into other milk products, such as butter or milk powder, which have a longer shelf life. This is compounded by increased staff absence levels resulting from either illness or efforts to prevent the spread of COVID-19. This has reduced the sector’s capacity for processing surplus raw milk.

This is only part of the problem, and the obvious solution of trying to redirect milk to sources of need is not an option available to most farmers. Milk supply contracts with processors include strict exclusivity provisions requiring farmers to remain in agreement with their processors and preventing them from finding other supply outlets.

The Tenant Farmers Association (TFA) called for the government to coordinate an emergency response to the current crisis within the dairy sector. Due to the enforced closure of most of the foodservice sector, the industry requires coordination to ensure that products intended for the foodservice sector can be redirected to consumers (see Legal update, FA calls for government support for dairy sector crisis).

The pre-COVID-19 issues of lack of a seasonal workforce and the shortage of labour for fruit and vegetable harvests in the farming industry have reached a critical point during the COVID-19 crisis, with skilled seasonal workers unable to travel into the UK.

On 20 March 2020, farm leaders were reported to be urging for a “land army” to be recruited because of the pending shortage of farmworkers that COVID-19 movement restrictions will cause (see Legal update, COVID-19: call for land army).

On 8 April 2020, UK in a Changing Europe published an analysis of the working conditions of migrant key workers in key sectors such as agriculture and food production during the COVID-19 crisis. This research indicates that there is still a significant shortage of workers in agriculture (see Legal update, COVID-19: analysis published on working conditions of migrant key workers in the COVID-19 crisis).