Highlights

- The shift towards electronic business platforms and frequent improvements in information technology encourage businesses to update their systems, generating demand for computer consultancy services (Ibis World, 2021[1])

- The market size of the UK’s App and Software Development segments increased faster than the Information and Communication sector overall in 2021 (Ibis World, 2021[2]; Ibis World, 2021[3]).

- Successful fintechs are primarily concentrated in London, followed by regional centres like Manchester, Leeds and Edinburgh (S&P Global, 2021).

- The Coronavirus outbreak encouraged video gaming demand (Ibis World, 2021[4]).

Key Developments

- Computer Consultancy Services: After stagnating during the COVID-19 pandemic, revenue is forecast to rebound in 2021-22

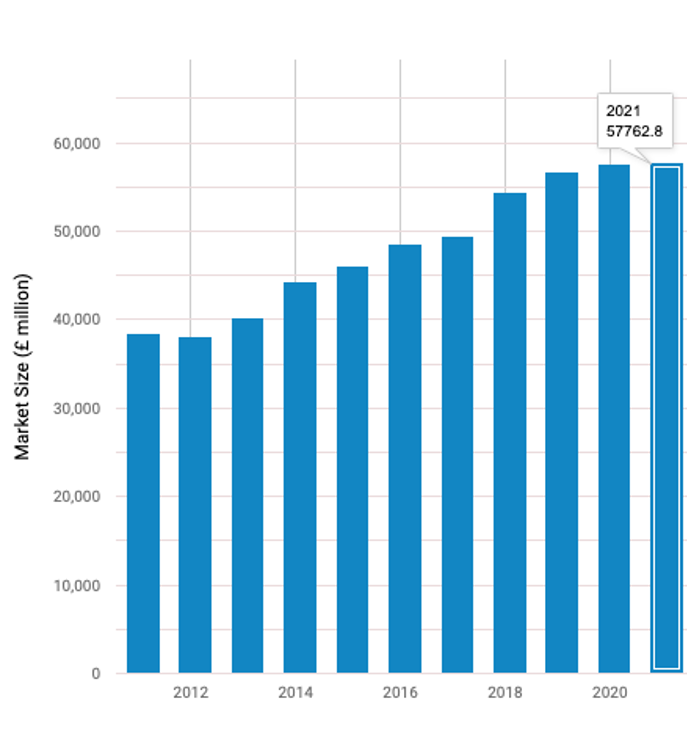

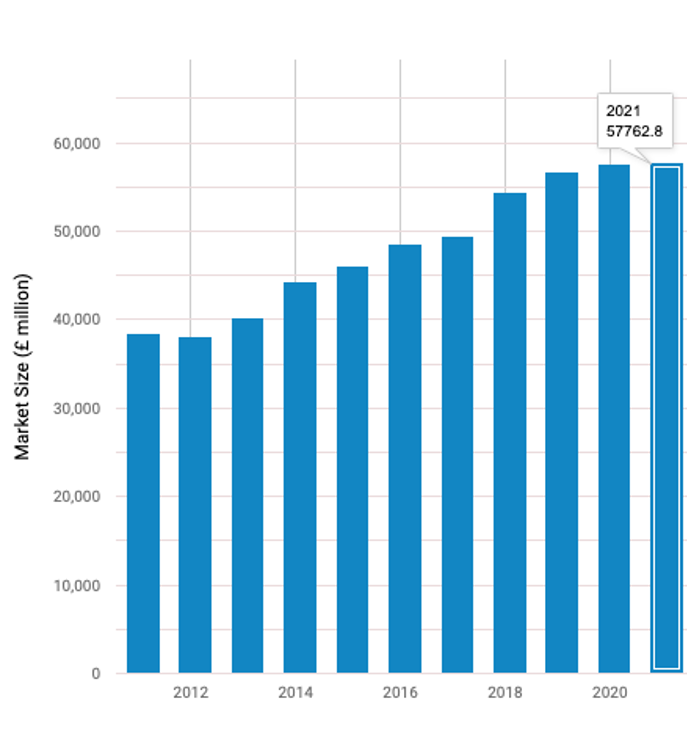

Business confidence fell significantly in 2020-21 due to the damaging economic effects of the coronavirus pandemic. This weighed on industry revenue, as businesses deferred planned investment in IT systems and upgrades. Industry demand was dampened over the same period from the manufacturing, wholesale and retail sectors because of their significant decline in performance due to business closures and social distancing. Combined, these sectors are expected to account for 20.5% of industry revenue in 2021-22.

On the contrary, Government expenditure has increased since the coronavirus outbreak, which bolstered industry demand from the public sector. IBISWorld estimates that the public sector will account for approximately 23.4% of industry revenue in 2021-22 (Ibis World, 2021[5]).

As of August 2021, the computer Consultants industry is worth around £57.8bn (Ibis World, 2021[6]).

Image source

- App Development: Digitalisation of daily tasks drives up demand, while Low barriers to entry make the competitive landscape more aggressive.

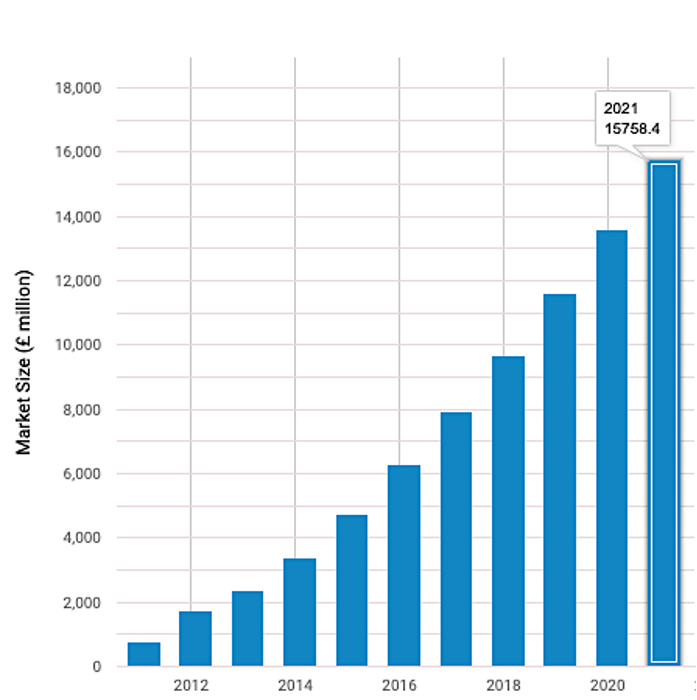

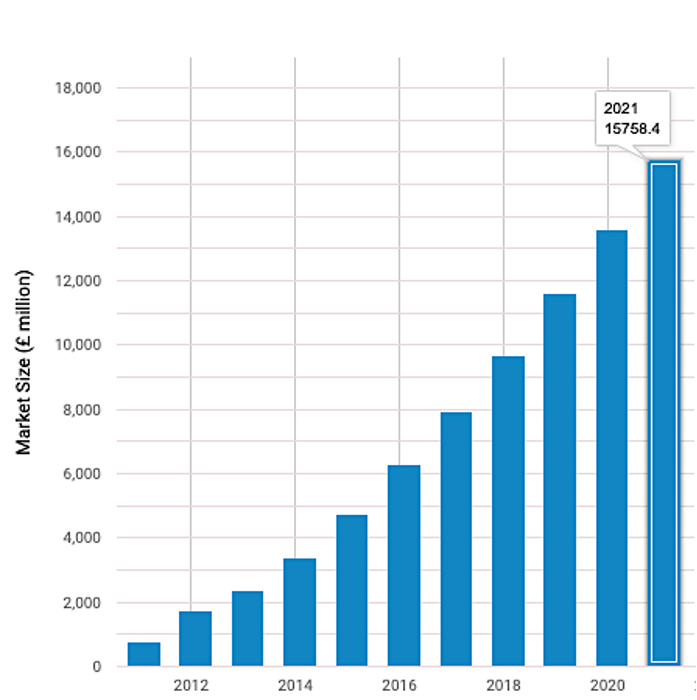

The App Development industry is the 4th ranked Information and Communication industry by market size and the 56th largest in the UK, and it has grown 20.1% per year on average between 2016 and 2021. The sector’s most significant opportunity currently lies in daily routine facilitation. As consumers and businesses adapt to technological change, they are more likely to use mobile apps to carry out everyday tasks. Nevertheless, the primary negative factor affecting this industry is low barriers to entry, increasing competition (Ibis World, 2021[7]).

- The market size, measured by revenue, of the App Development industry, is £15.8bn as of September 2021, noting 16.1% growth from last year (Ibis World, 2021[8]).

Image source

- Data Processing & Hosting Services: Resilient and Projected to continue to thrive

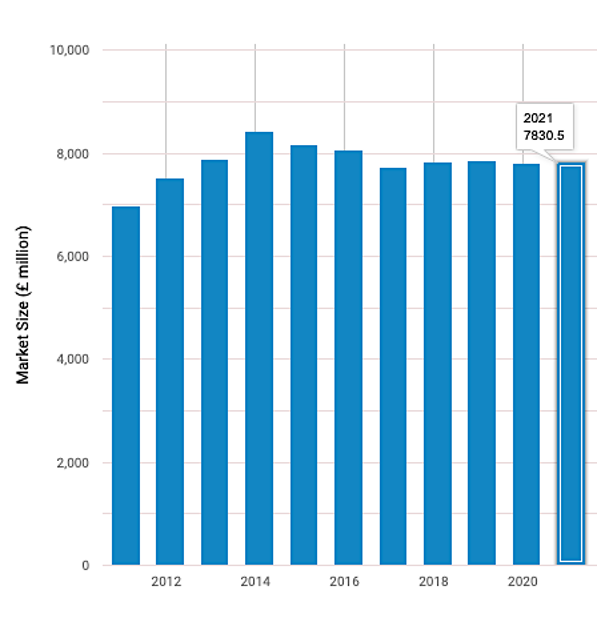

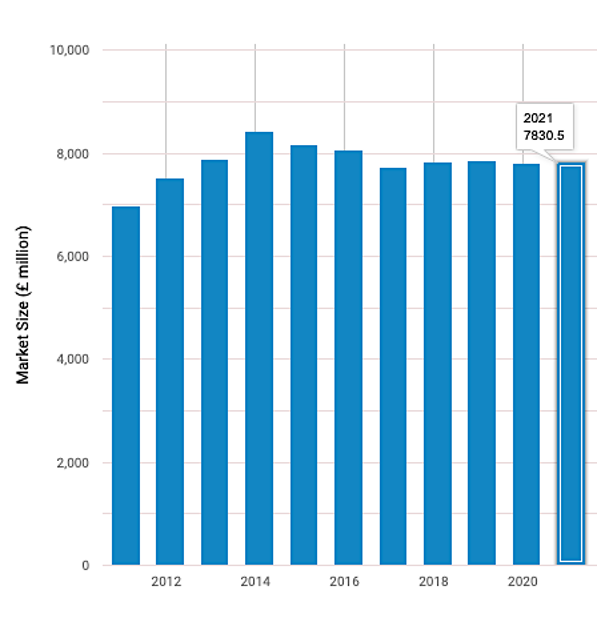

Industry operators continued to operate somewhat normally throughout the pandemic, providing data processing and hosting services to customers since the sector’s digital nature means that innovation and software sales were less prone to the adverse effects of the coronavirus pandemic than industries that rely on the sale of physical products. The coronavirus outbreak heightened demand for industry services that provide benefits for organisations shifting their staff to working from home, with many businesses in the United Kingdom closing offices over 2020-21 and to a certain extent over the current year (Ibis World, 2021[9]).

The market size, measured by revenue, of the Data Processing & Hosting Services industry, is around £7.8bn in 2021, noting a 0.4% increase from last year (Ibis World, 2021[10]).

Image source

- Computer Game Publishing: Console-action due to virus-related restrictions and opportunities for expansions within the sector

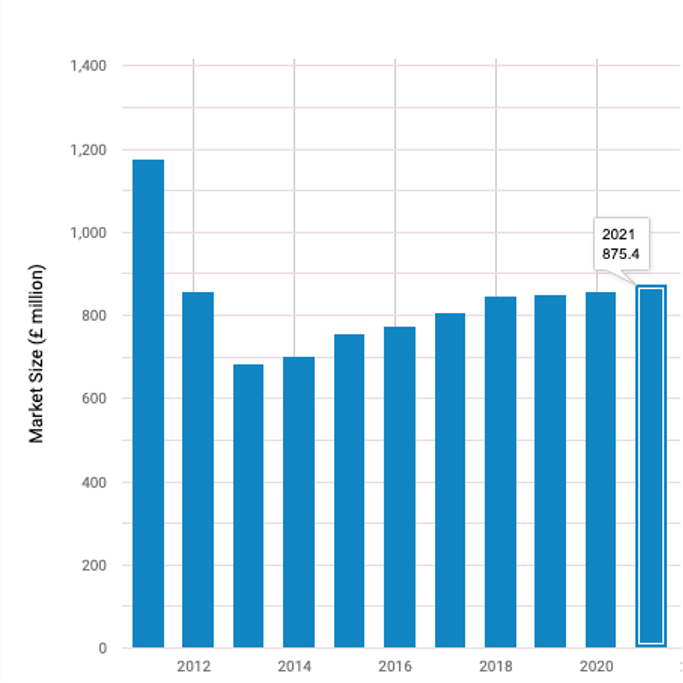

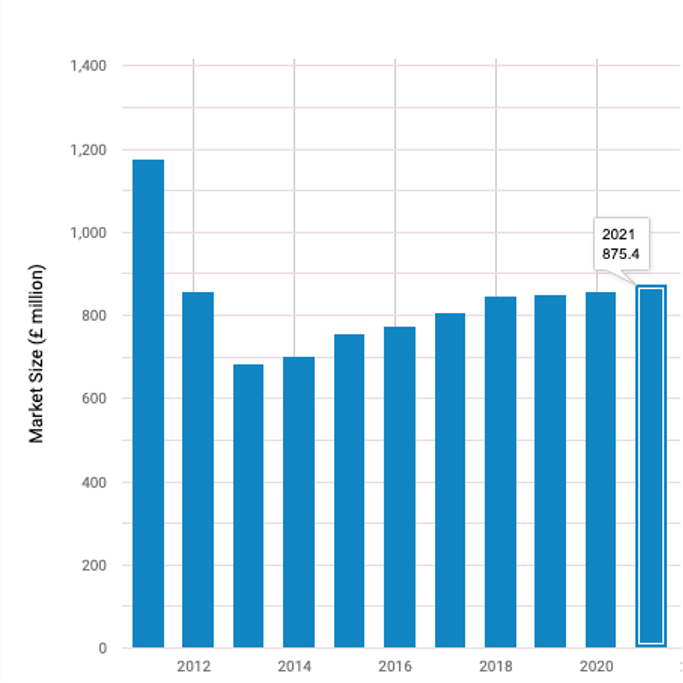

British gaming insight provider TheGamingEconomy.com suggests that some gaming studios have faced a fall in productivity of approximately 20% due to the difficulty arising from teams working remotely. However, the coronavirus outbreak has presented a significant opportunity for the specific segment. Responsive measures to combat the spread of coronavirus have consisted of enforced nationwide lockdowns and advised social distancing, which has led to a surge in the number of times consumers are at home and free to play video games.

Moreover, its largest market, online and digital sellers, is projected to expand significantly. This is because social distancing measures and enforced closures of physical stores have changed gamers’ spending patterns, altering their purchasing habits to online avenues (Ibis World, 2021[11]).

- The market size, measured by revenue, of the Computer Game Publishing industry is £875.4m in 2021, noting a 2% increase since last year (Ibis World, 2021[12]).

Image source

- The Fintech market has been booming

The UK Fintech ecosystem continues to thrive with a solid entrepreneurial community working alongside established firms, a large client base, a growing influx of investors domestic and foreign, all with the benefit of government support. In this context, S&P Global (2021) conducted an analysis of the UK Fintech market, highlights from which include:

- The Top 16 Fintech Unicorns in the UK have an aggregate market cap of £60bn.

- Fintechs across the UK are thriving with higher concentrations in London, followed by regional centres like Manchester, Leeds and Edinburgh.

- 28 Fintech M&A transactions were completed in 2020, and volume has not slowed down in 2021, with 19 deals just in H1