Target status: x

Upload date: 11/12/2019

Last updated on: 07/01/2021

Who are the important people in the company?

• Douglas John

Correspondence address: 20 Western Avenue, Milton Park, Abingdon, Oxfordshire, United Kingdom, OX14 4SH

Date of birth: January 1962

Nationality: Australian

Country of residence: England

Occupation: CEO

• Catherine Janet Glickman

Correspondence address: 20 Western Avenue, Milton Park, Abingdon, Oxfordshire, United Kingdom, OX14 4SH

Date of birth: September 1957

Nationality: British

Country of residence: England

Occupation: Non-Executive Director (not sure if she is still active)

• Kenneth Lever

Correspondence address: 20 Western Avenue, Milton Park, Abingdon, Oxfordshire, United Kingdom, OX14 4SH

Date of birth: September 1953

Nationality: British

Country of residence: England

Occupation: Non-Executive Chairman

• Michael McKelvy

Correspondence address: 20 Western Avenue, Milton Park, Abingdon, Oxfordshire, United Kingdom, OX14 4SH

Date of birth: March 1959

Nationality: American

Country of residence: United States

Occupation: Independent Non-Executive Director

• Gary Richard Young

Correspondence address: 20 Western Avenue, Milton Park, Abingdon, Oxfordshire, United Kingdom, OX14 4SH

Date of birth: January 1960

Nationality: British

Country of residence: England

Occupation: Group Finance Director

What is the structure of the company?

• Statement of Capital

Class of Shares: ORDINARY

Currency: GBP

Number Allotted: 276,875,403

Nominal value: 8,306,262.09

Amount paid per share: 33,33

Amount unpaid per share: 0

Prescribed Particulars:

Each Share is entitled to one vote in any circumstances.

Each share has equal rights to dividends. Each share is entitled to participate in a distribution arising from a winding-up of the company.

• Statement of Capital (Total)

Currency: GBP

Total Number of shares: 276,875,403

Total Aggregate nominal value: 8,306,262.09

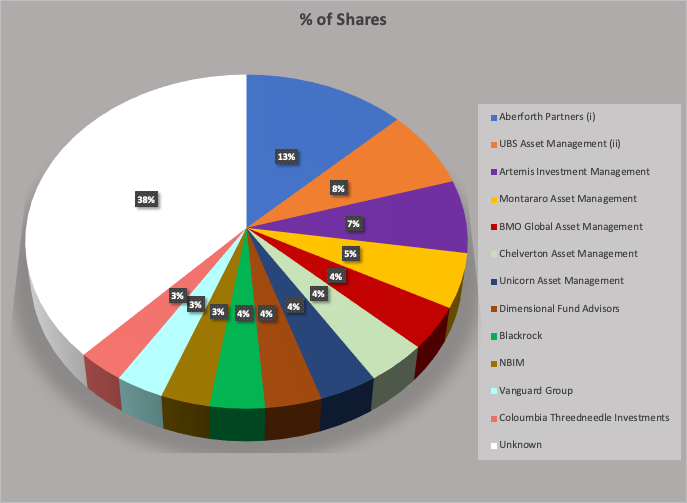

Based on their latest Annual Report (2019:54) the company’s substantial shareholdings as at 18 February 2020 are the following:

Significant Notes:

(i) The Welcome Trust Ltd as Trustee of the Welcome Trust holds 3.13% shares included within the shares held by Aberforth Partners

(ii) Tameside MBC through Greater Manchester Pension Fund holds 6.08% shares included within the shared held by UBS Asset Management

Key People per Institutional Shareholder

Aberforth Partners

• Co-Owner: Keith Muir

• Co-Owner & Fund Manager: Christopher Watt

• Head of Fund Operations at Aberforth Partners: Michael Campbell

UBS Asset Management

• CEO at Tameside MBC: Steven Pleasant

• UBS Asset Management MD in London: Susan Hudson

• Group CEO: Ralph Hamers (Switzerland based)

Artemis Investment Management

• CEO: John Dodd

Montararo Asset Management Limited

• CEO: Cedric Durant des Aulnois

BMO Global Asset Management

• Group CEO: Kristi Mitchem (based in US)

Chelverton Asset Management Limited

• MD: David Horner

Unicorn Asset Management

• CEO: Sebastian Diemer (based in Germany)

• UK FD: Philip John

Dimensional Fund Advisors

• Co-CEO: Dave Butler

• Regional Director: Andrew Walker

Blackrock

• Chairman & CEO: Larry Fink

• Head of UK: Sarah Melvin

NBIM (Norges Bank Investment Management)

• CEO: Nicolai Tangen

Vanguard Group

• CEO: Tim Buckley (US-based)

Columbia Threadneedle Investments

• EMEA, APAC CEO: Nick Ring

What is the prospect’s strategy and ambitions?

Strategy

- Organic Growth and Selective Acquisition:

In 2019 the company acquired Corview and Reservoir Imaging Ltd while noting 19% of fee organic growth in the Republic of Ireland.

- Brand Reconstruction:

They have significantly invested to achieve a new look of RPS Group and they have made substantial progress with the brand, social media presence, communication and people management.

- Employee Engagement & Retention Focused:

They are working on improving their HR Practices aiming to lower employee turnover statistic. Although this has not yet taken place, colleagues are evaluated in a consistent way and reviewed routinely. They also utilise employee engagement surveys to collect feedback.

- Although RPS offers a diverse array of services, the markets they primarily address are those impacted by the demands of population growth such as energy, water, infrastructure, transport and the environment.

- The future for RPS is about being at the forefront of changing market trends, identifying growth opportunities and delivering complex solutions in a way that is easy to understand and implement. Alongside investment in RPS’ brand, 2019 will see a continuation of the focus and investment in its people, technology and innovation to build on the deep expertise that its clients have recognised and give it a stronger competitive edge in all the markets that it operates in.

Ambitions

- Further Geographical Expansion on a global level

- Increase their Brand Attractiveness

- Enhance their Business Model to achieve satisfying levels of employee engagement and retention

- Grow both organically and through selective investments

Who are the prospect's customers?

• Their clients work across six sectors all over the world: property, energy, transport, water, resources, defence and government services

Client Examples

CEO: Keith Anderson

CEO: Jean-Michel Jacoulot

What does the prospect consider important for its customers?

• Delivering reliable, validated data, and safer products to the market

• Making complex easy to understand

• Trusting experienced consultants

Who are the prospect's staff?

The average number of employees (including directors) employed by the group and company during 2019, amounted to 4,974 (2018:5,556).

2019

Fee earning staff: 4,129

Support staff: 845

Employee Reviews on Indeed

Overall Rating: 3.5/5

Analytical Rating:

- Work-life Balance: 3.4/5

- Pay & Benefits: 3.2/5

- Job security & Advancement: 2.9/5

- Management: 3.1/5

- Culture: 3.3/5

Leakage Technician (Former Employee) – Cumbria – October 30, 2020 (1/5)

“Avoid this firm if you want to progress

I’d never work for that shower again minimum pay minimum holidays maximum stress no support very little training no chance of career progression your better off at tesco”

Pros

None

Cons

Poor pay and conditions

Leak detection number 2 (Former Employee) – Plymouth, Devon – August 27, 2020 (1/5)

“Wouldn’t recommend

I have worked for them for 2 years was not provided the proper training the wages is minimum wage I had a personal meeting was told it was confidential and I’m not aloud to record the meeting but they were happy enough to tell everyone else what happened in the meeting there is no private data protection law wouldn’t waste your time communication is terrible.

I’ve asked them a thew times about taking holiday on certain days they did not get back to me the only good thing from the company is vans and fuel cards and you also get a work phone and if you had a 2nd accident they will expect you to pay for the damage and also any damage after first accident the apply a 20% vat charge and also because I left due to them breaking my data protection haven’t paid me and spoken to me on the phone Tuesday saying how they apologise for my information getting out as I said I won’t come back they’ve decided to keep my wages.”

Pros

Vans, fuel cards, phones

Cons

Wages

What are the prospect’s unique selling points (USPs)?

• They operate across six sectors: property, energy, transport, water, resources, defence and government services.

• Their services span twelve clusters: project and program management; design and development; water services; environment; advisory and management consulting; exploration and development; planning and approvals; health, safety and risk; oceans and coastal; laboratories; training and communication and creative services.

• It is a business rooted in great fundamentals:

A good and improving safety record- but no complacency

Profitable with healthy margins

High levels of cash conversion and good cash flow

A strong balance sheet and supportive lenders

A diversified client-based

Quality People

• Building deep expertise since 1970

What are the prospect’s business activities and potentials?

Founded in 1970, RPS is a leading global professional services firm of 5,600 consultants and service providers. Located in 125 countries across all six continents they define, design and manage projects that create shared value to a complex, urbanising and resource-scarce world.

Locations

Headquarters: Abingdon, England

20 Western Avenue, Milton Park

Abingdon, England OX14 4SH, GB

Aberdeen Office:

9 Queens Road, Aberdeen, AB15 4YL

Located in 125 countries

Offices in Australia, Asia Pacific, North America, Europe

Social Media

Published articles and awards

Case Studies available here.

Who are the prospect’s competitors?

Competitors List (alphabetical order)

Criterion: Industry subcategory, Company Size and Product

AECOM Limited

Employee Count: 4,116:2019

ARUP

Emloyee Count: 10,001+ (based on their LinkedIn Profile, section “About”)

ATKINS Limited (owned by SNC-Lavalin)

Employee Count: 7,670:2019

Environmental Resources Management Limited (part of ERM global)

Employee Count: 387:2019

SLR Consulting Ltd (part of SLR Global)

Employee Count: 408:2019

How helpful was this profiling? Help us improve by rating!

(1 star=Not helpful, 2 stars= Slightly helpful, 3 stars= Moderately helpful, 4 stars=Very helpful, 5 stars=Extremely helpful)