Highlights

The hospitality industry was responsible for 40% of the UK’s total economic growth between the first and second quarters of 2021 (The Spirits Business, 2021).

• Payroll costs for many hotel operators, typically ranging from 25% to 35% of total expenses (Savills UK, 2021).

• Hospitality staff say frustrated customers have left them demoralised and upset, with some at “breaking point”. Industry bodies say 1 in 5 hospitality workers have left the sector during the coronavirus pandemic. (BBC, 2021).

• Nightclubs in the UK Market Size Growth in 2021 was -84.2% (Ibis World, 20219).

• Pop-up Restaurants and Dark Kitchens are penetrating the market (Point Franchise UK, 2021; UK Tech News, 2021)

Key Developments: Hotels

Drawing on insights from their operator survey, Savills UK look beyond the headlines of the staff availability crisis facing the hotel sector:

Image source: Savills UK, 2021

Government data and news headlines suggest that a very dire staffing crisis is hitting the hospitality sector. Office for National Statistics (ONS) figures show that job vacancies in the accommodation and food services sector reached 134,000 between June–August 2021. This is the highest level on record and marked a 41.1% increase from pre-Covid levels. In ratio terms, this means that accommodation and food services has the highest number of vacancies per 100 employee jobs of any UK sector, standing at 5.9% – up from 4.1% over the same period in 2019 (Savills UK, 2021).

• The impact of staff shortages differs across industry segments

While the staff shortage ‘crisis’ is considered an industry-wide issue, its level of impact varies considerably across different segments. The budget and serviced apartment sectors are likely to prove more insulated; both tend to have lower headcounts, and the latter requires a reduced frequency of room servicing in line with the longer-stay profile of guests. This relative insulation was evident from survey responses, with only 17% of serviced apartment operator respondents rating staff availability as being inadequate enough to require reducing service levels to cope, as opposed to 47% of hotel operators (Savills UK, 2021). Investors and Lenders raising concern about the profitability and financial resilience of hotel operators The upward pressure on wages, alongside increasing food and energy costs, was already compressing operational margins before the pandemic. This appears set to continue. However, an acceleration in payroll costs is a more pressing concern, as it tends to be the single biggest P&L cost for hotel operators, typically ranging from 25% to 35% of total costs. This acceleration raises questions around profitability and the ability to fulfil debt and rent obligations (where applicable). It also impacts the ability of operators to maintain their properties, which feeds into operational performance and the operator’s ability to deliver enhanced returns (Savills UK, 2021).

Key Developments: Food & Beverage

• Stability in Food-delivery and takeaway sales growth Growth in delivery and takeaway sales began to slow in July 2021 as hospitality fully reopened, and consumers returned to eating out. Nevertheless, July’s delivery and takeaway sales were 206% higher than in 2019 (MCA Insight, 2021). In fact, despite the return of dine-in restaurant eating, between July and September 2021, Deliveroo enjoyed a 59% increase in orders in the UK and Ireland. Meanwhile, a partnership with Amazon more than doubled members of its premium subscription service (The Guardian, 2021).

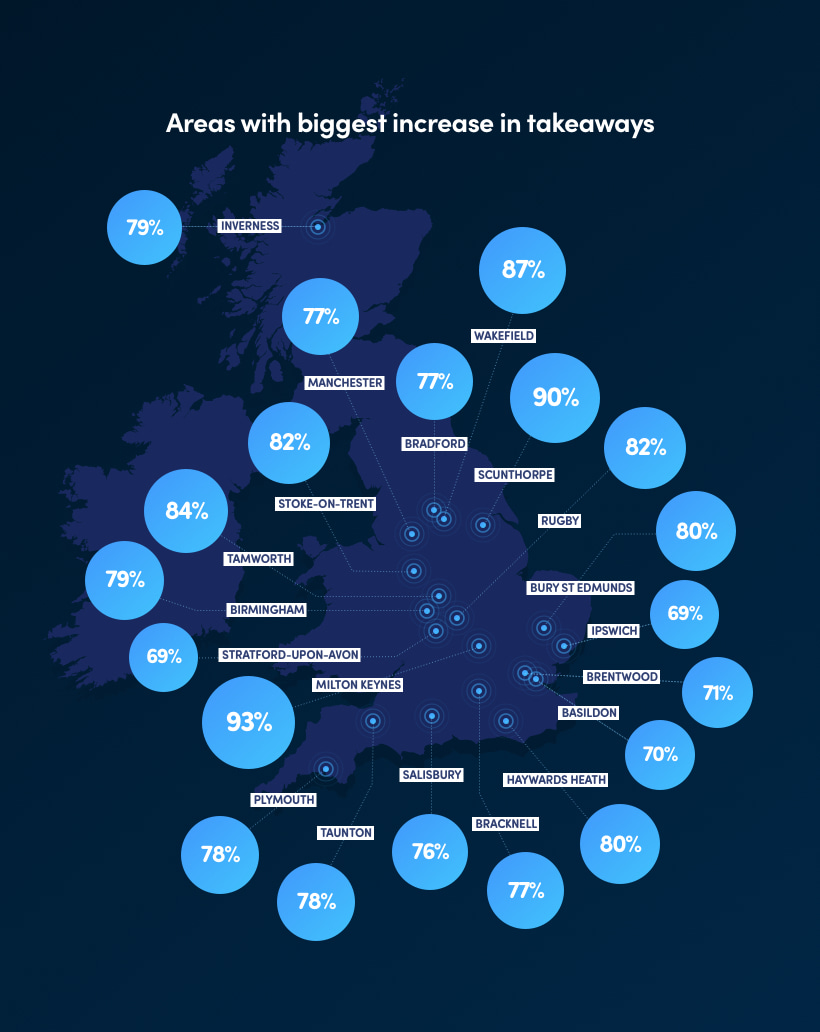

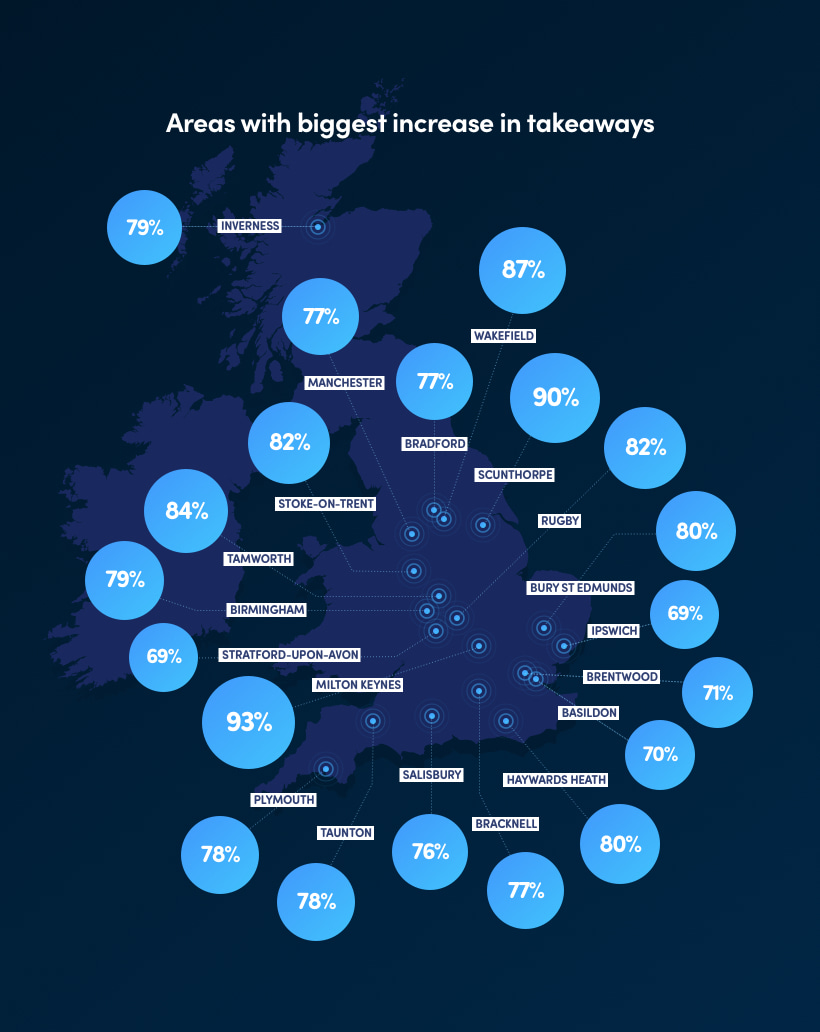

Areas in the UK that have seen the greatest percentage rise in takeaway food orders between 2020 and 2021.

Image source

• Pop-up Restaurants are becoming popular in the culinary game

Another trending feature of the food services market is the Pop-up restaurant. A pop-up restaurant is a temporary restaurant that appears for a short period to give customers a taste of what’s on offer. Often a fixture of festivals and events, pop-up restaurants have surged in popularity over the past two years, as they enable restaurant-goers to ‘test the waters’ at a relatively low cost. They also offer an opportunity for young professionals to enter the culinary game and make a name for themselves (Point Franchise UK, 2021)

• Dark Kitchen start-ups on the rise

Recently, London has seen a plethora of dark kitchen start-ups (also known as virtual kitchens or ghost kitchens). These kitchens require no tables or wait staff, as they prepare food strictly for delivery. They operate in vacant spaces such as shipping containers and retail spaces and are equipped with modern kitchen equipment to prepare and distribute dishes efficiently. Dark kitchens are presently thriving; an estimated 750 are operating in the UK alone, with more being established daily throughout the US and Europe. (UK Tech News, 2021). According to food consultant Peter Backman, they represent “the answer to a prayer” for many restaurants. With takeaways surging in popularity over the course of the pandemic, kitchen space

Consequently, dark kitchens have become a flourishing annexe to the food economy. An estimated 750 of them operate in the UK alone, with more being set up every day in the US and Europe. For many restaurants, they’re “the answer to a prayer,” says food consultant Peter Backman. With takeaways leaping in popularity since the pandemic, so too has the premium on kitchen space. Dark kitchens allow them to move orders off-site in facilities with much lower rents, according to Backman (Tech Monitor, 2021).

The chart below shows the areas in the UK where dark kitchens (or ‘ghost kitchens’) have seen the most significant increase in number when we compare 2020 to 2021:

Image source

- A Night Time Industries Association survey of over 100 nightclubs in February 2021 has found that 43% had not received any grant support from the government. Only 12 nightclubs have been awarded finance from the £1.57 billion Culture Recovery Fund (Ibis World, 2021[1]).

- Nightclubs are of the hardest-hit segment, but consumer confidence is expected to be in their favour

An online survey conducted by the All-Party Parliamentary Groups (APPG) during the four weeks through 7 February 2021 found that 92% of nightclubs had traded for six months or less during the pandemic (Ibis World, 2021[2]). Nightclub admissions are affected by consumers’ confidence in the economy and conditions that affect spending. When consumer confidence is lower, demand for out-of-home activities such as going out and spending money in nightclubs is likely to decrease. As the economy recovers from the coronavirus pandemic, consumer confidence is expected to improve in 2021-22. This presents an opportunity for industry operators (Ibis World, 2021[3])

- US Wendy’s expansion strategy in the UK, both with restaurants and dark-kitchens

US burger chain Wendy’s has revealed a relaunch in the UK is proving so successful bosses plan to open a further 50 sites across the country next year.

The fast-food business said it was seeking franchise partners and had eyes on moving into Europe with launches in France, Germany and Spain.

In the UK, Wendy’s recently opened five restaurants in Reading Stratford, Oxford, Croydon and Romford, having left these shores in 1999 and opened five dark kitchens in partnership with REEF to offer deliveries on food platforms including Deliveroo and Uber Eats (Yahoo Finance, 2021).