Highlights

- There are multiple opportunities for UK consultants to help their clients understand the economic effects of the pandemic and plan their post-pandemic strategies (Ibis World, 2021[1]).

- Increased demand for litigation, restructuring services and employment law expertise in industries heavily affected by the current economic crisis (Ibis World, 2021[2]).

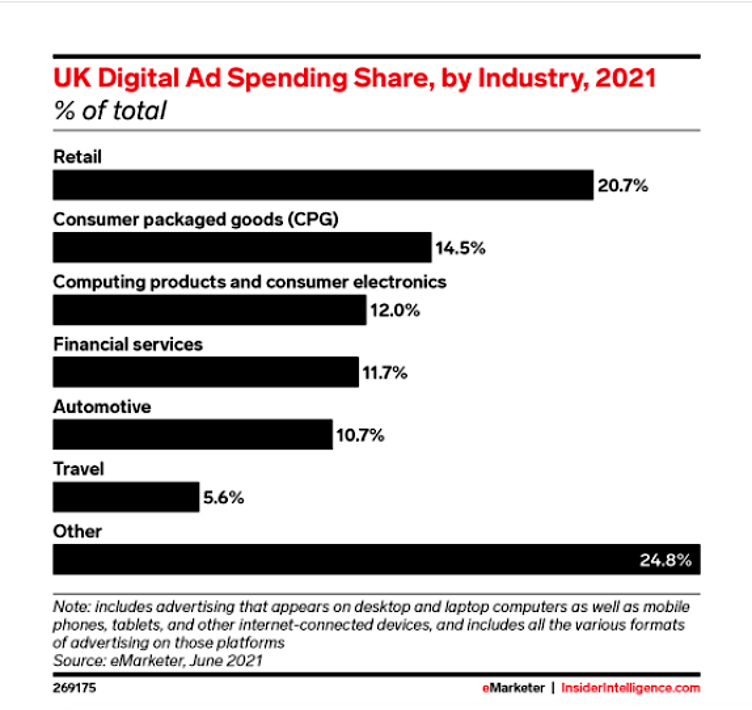

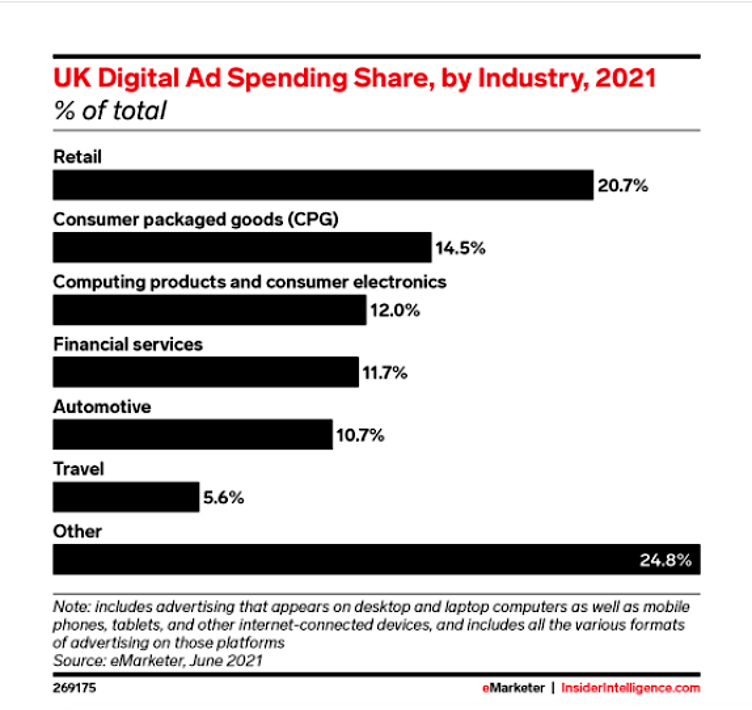

- Retail is the biggest spender in Digital Advertising for 2021, holding 20.7% of the UK Digital Ad Spending share (EMarketer, 2021).

- The architectural profession is battling increasing demand, ‘huge’ staff shortages and inflation (Architects’ Journal, 2021)

Key Developments

Reduction in fees, operational restructures and uneven demand for UK consultants

UK consultants reported a significant reduction in fees following the coronavirus outbreak, with many sectors reducing their consulting expenditures in 2020-21. However, some firms benefited from restructuring services as they adjusted to new operating conditions. Though industry revenue declined in 2020-21, there was increased demand in certain areas of consulting. For instance, demand for IT strategy consulting soared while demand for process and operations management consultancies decreased. (Ibis World, 2021[3]).

Management Consulting on the post-pandemic and post-EU environment is expected to support growth

The pandemic has significantly impacted several downstream sectors, such as financial services, manufacturing, healthcare, and energy. Currently, the industry has a greater opportunity to provide services to clients to help them understand the economic effects of the pandemic and plan their strategies going forward (Ibis World, 2021[4]).

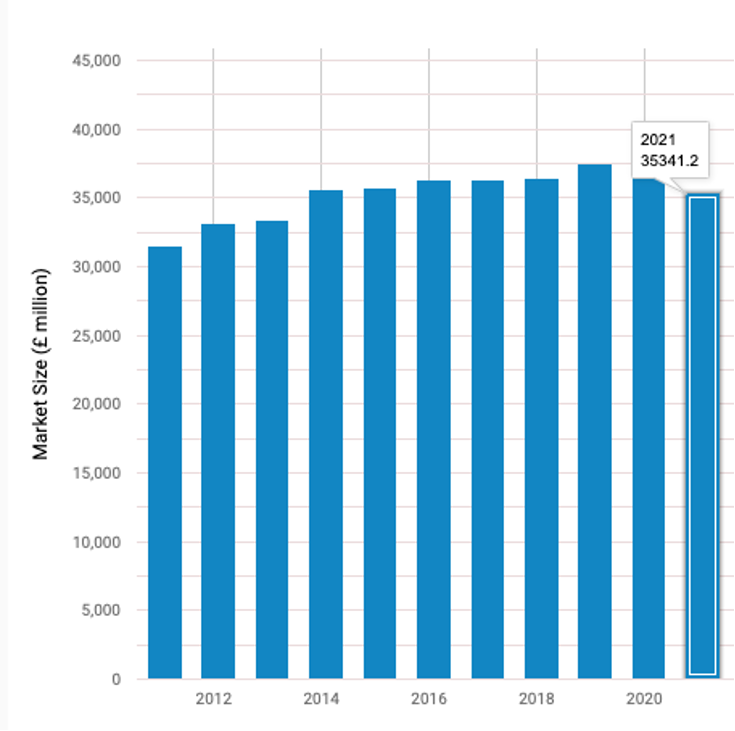

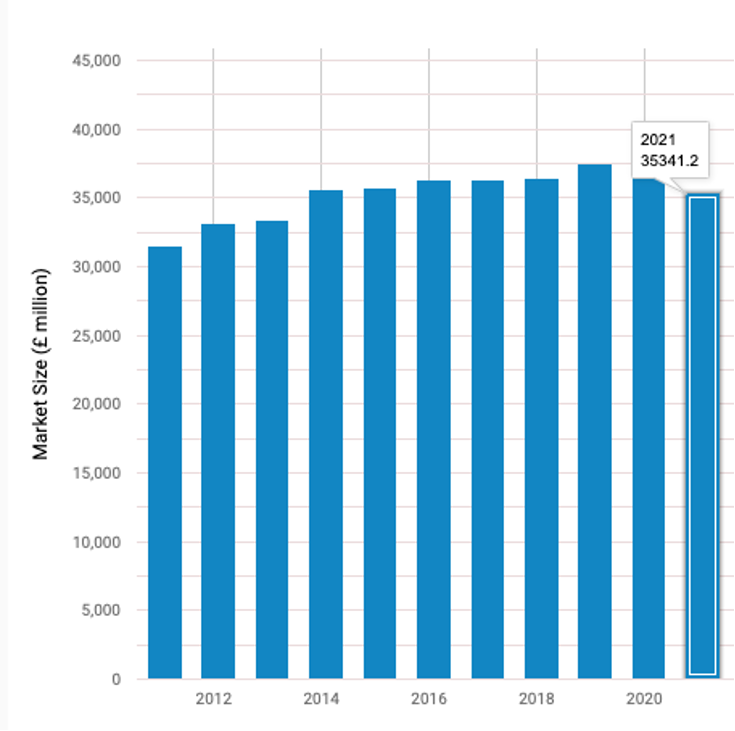

Legal Services: Revenue decline and mitigation

Legal services market size for 2021 is £35.3bn, which is -7.4% compared to last year (Ibis World, 2021[5]).

Image source

This decline in industry revenue is expected to be mitigated by the countercyclical nature of certain services. For example, demand for litigation and restructuring services, particularly from companies in industries heavily affected by the current economic crisis, has risen. Additionally, there is increased demand for employment law advice, particularly regarding furlough leave and redundancies (Ibis World, 2021[6]).

Advertising: Which industries are the biggest spenders?

In 2021, UK digital ad spending will grow by 16.8% to £19.23 billion ($24.66 billion). As the pandemic recovery continues, retail will contribute the most to that total. In 2021, retail will pull even further ahead of all other categories, with sales of £3.98 billion ($5.11 billion). The consumer-packaged-goods (CPG) industry will rank second, reaching £2.79 billion ($3.58 billion). Meanwhile, despite some rebound from 2020, travel will remain at the bottom of the ranking with £1.07 billion ($1.38 billion) in spending (EMarketer, 2021).

Image source

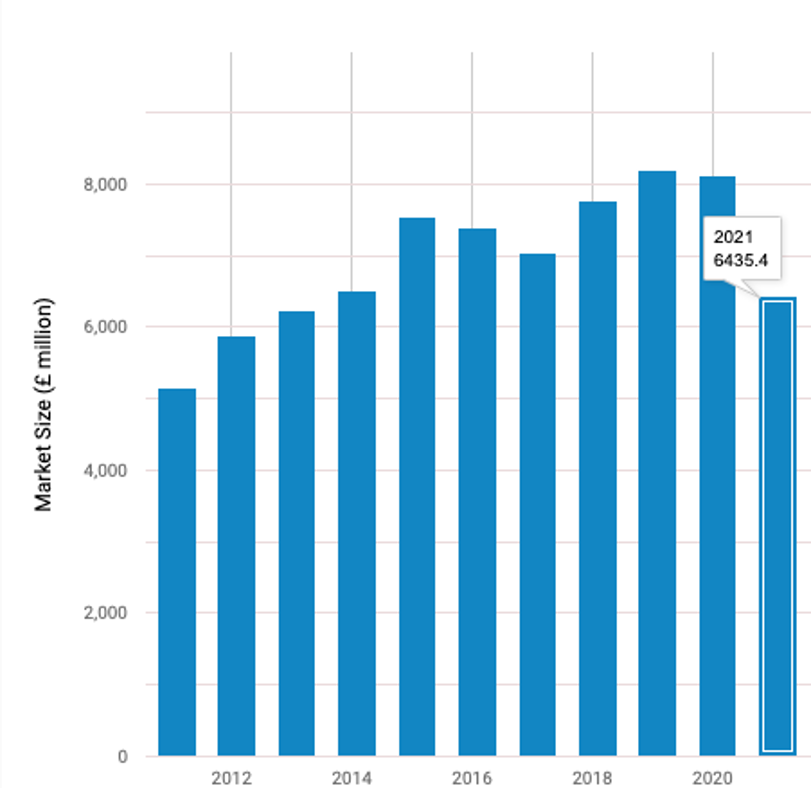

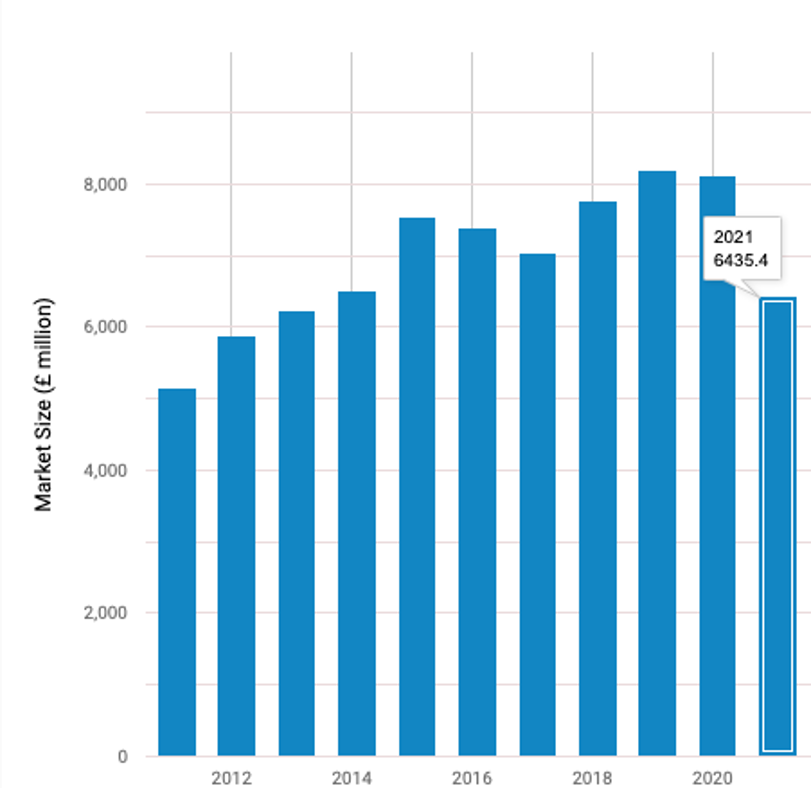

In 2021, the market size of the Architectural Activities industry, measured by revenue, is £6.4bn, a 20.7% decline from 2020 (Ibis World, 2021[7]).

Image source

Given that construction output fell by 12.5% in 2020 (Office for National Statistics), this decline is unsurprising (Ibis World, 2021[8]).Nevertheless, the architecture profession is currently battling increasing demand, ‘huge’ staff shortages and inflation caused by Brexit and the pandemic. The RIBA’s September Future Trends 2021 survey found that 18% of practices are having difficulty finding staff. More than 40% of large and medium practices have said they are short-staffed. Recruitment agencies in the sector have confirmed these findings. Bespoke claimed to be experiencing a ‘huge shortage’ of qualified candidates and ‘very little movement across all levels’.

Positives include a strengthening market in the capital, improving employment opportunities, little chance of widespread redundancies as furlough ends, and a recovery extending beyond private housing into the commercial sector (Architects’ Journal, 2021).