Highlights

- Last-mile logistics focus on the best possible customer experience (Business Wire, 2021).

- According to the UK Logistics Sector M&A Index survey Q1 2021, M&A activity within the industry has increased 23% since 2020 (CBW & Logistics UK, 2021).

- Ocean Freight: There is a desperate lack of available empty containers and a need for truck drivers (Lloyds Loading List, 2021).

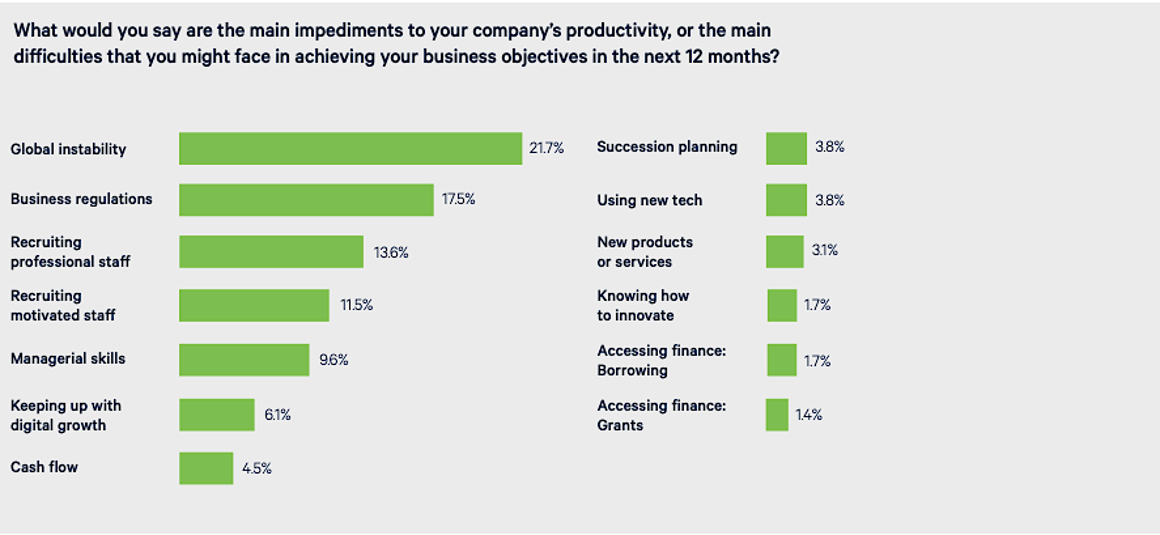

- Top 3 challenges for logistics business leaders for 2022 are: Global Instability, Business Regulations and Recruitment (CBW & Logistics UK, 2021).

Key Developments

E-Commerce growth and increasing competition

The supply chain needs to respond to heightened competition in the last mile as e-commerce operations grow in the wake of the coronavirus. Last-mile logistics will be highly competitive as companies look to their supply chains to give the best possible customer experience. This will call for technological innovation to enable retailers to scale-up fast home delivery systems once normality returns (Business Wire, 2021).

Appetite for M&A

Against a backdrop of the extraordinary and historical changes affecting UK logistics, CBW Q1 2021 M&A Index survey updates changing business sentiment over the six months since their first survey in September 2020.

Their Index number for this survey is 55.7 – up from 45.4 in their inaugural survey in September 2020. This represents a significant increase in appetite for M&A activity and a more optimistic outlook for the sector in the context of the impact of Brexit, continuing uncertainty around the effects of Covid-19 and challenges facing the global economy. As a result, it is expected to see further consolidation in the sector over the next 12 months.

Image source (CBW & Logistics UK, 2021)

Optimism increases as pandemic fears recede, but concern remains about global uncertainty, recruitment and red tape

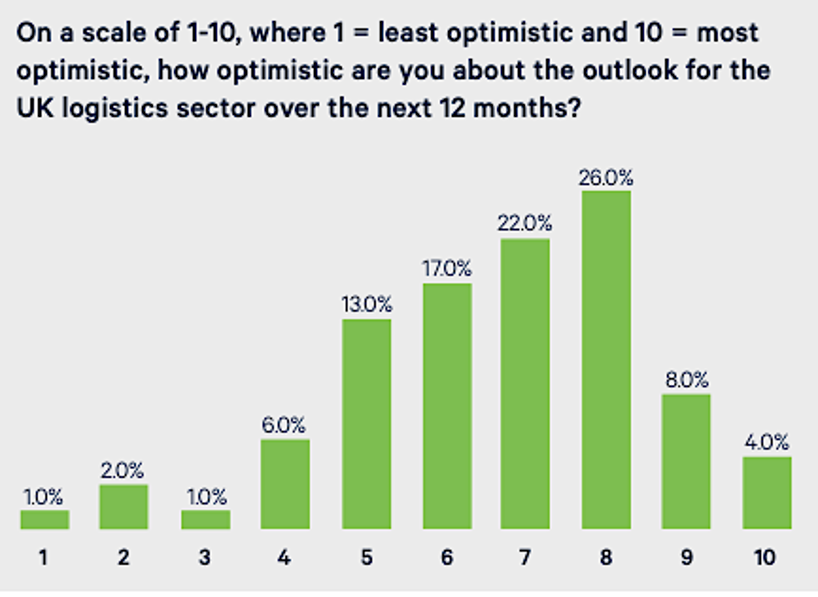

Optimism about the outlook for the logistics sector over the next 12 months has increased slightly, despite the challenges of the pandemic and the UK’s new trading relationship with Europe. Asked to rate how optimistic they are over the next 12 months, on a scale of 1-10, CBW’s sample of business leaders in the sector returned an average score of 6.7 out of 10 – up 6% from 6.3 in 2020.

Image source (CBW & Logistics UK, 2021)

Ocean Freight Market Volatility: Driver shortage, port congestion, covid-related restrictions

According to Jens Lund, until recently, DSV’s long-standing CFO, now appointed to the newly-created post of chief operating officer (COO) at the Danish freight forwarding and logistics group, the supply chains are facing multiple problems right now on the ocean freight side. There are too few ship calls because the ports are already flooded with cargo, there is a desperate lack of available empty containers and a need for truck drivers. And on top of all that, there are all COVID-related restrictions with ports shutting down here and there, such as in China.

There are just too many (negative) factors, and nothing tells us that this will change in the foreseeable future. If it had been one vessel stuck in the Suez Canal, it would be different as things would normalise at a certain point in time. But that’s not the case. There are no signs of the situation normalising. We expect that in 2022 we will continue to be confronted by extraordinarily volatile market conditions – probably through next year (Lloyds Loading List, 2021).

Global uncertainty, recruitment and red tape are the main challenges in logistics

Unsurprisingly, global instability and uncertainty around Covid-19 is seen as the critical factor when our survey participants were asked to select the main impediments to productivity or the main difficulties they face in achieving their business objectives in the next 12 months.

Regulation and red tape, including in trade with the EU post-Brexit, is seen as an obstacle by 18% of respondents, increasing 12% from 2020. Comments from survey respondents highlight the need to establish reliable customs agents throughout Europe to accommodate all product types. At the same time, some operators worry about the impact of the Import of Products, Animals, Food and Feed System (IPAFFS) – the process that notifies authorities of movements of live animals and certain other commodities into the UK. Post-Brexit bureaucracy will be of particular concern to larger companies operating across several EU member states, but most companies will feel the impact to some extent if they are part of a wider supply chain that includes an EU territory.

Image source

According to our survey, it’s no surprise that the long-established sector challenge of finding staff with the right skills and attitude remains a significant difficulty. When combined with the cited lack of managerial and leadership expertise, the perennial issue of recruitment tops the list of impediments to growth at 35% (CBW & Logistics UK, 2021).