Target status: x

Upload date: 06/03/2020

Last updated on: 30/11/2020

Who are the important people in the company?

Danish Private Equity firm CataCap purchased a majority stake in the group, with the transaction concluding in mid-October. The analytical control hierarchy is presented in the Structure section.

Aerfin Holdings Limited

Correspondence address: Unit D, Parc Bedwas, Greenway, Bedwas House Industrial Estate, Bedwas, Caerphilly, Wales, CF83 8DW

Governing Law: England And Wales

Legal Form: Limited Company

Registration Number: 9353979

Nature of Control: Ownership of Aerfin Limited shares – 75% or more (Immediate controlling party)

• Mr Peter Ryttergaard

Correspondence address: Oster Alle 42, 7th , Copenhagen, Denmark, DK2100

Date of birth: August 1970

Nationality: Danish

Country of residence: Denmark

Nature of control

Right to appoint and remove directors

Right to appoint and remove directors as a member of a firm

Occupation: CataCap Partner

• Vilhelm Hahn-Petersen

Correspondence address: Oster Alle 42, 7th , Copenhagen, Denmark, DK2100

Date of birth: March 1960

Nationality: Danish

Country of residence: Denmark

Occupation: CataCap Partner

• Robert John James (or Bob)

Correspondence address: Unit D, Parc Bedwas, Greenway, Bedwas House Industrial Estate, Bedwas, Caerphilly, Mid Glamorgan, Wales, CF83 8DW

Date of birth: February 1964

Nationality: British

Country of residence: Wales

Occupation: Shareholder (10.5% of the company’s shares with voting rights entitlement) & Aerfin CEO

What is the structure of the company?

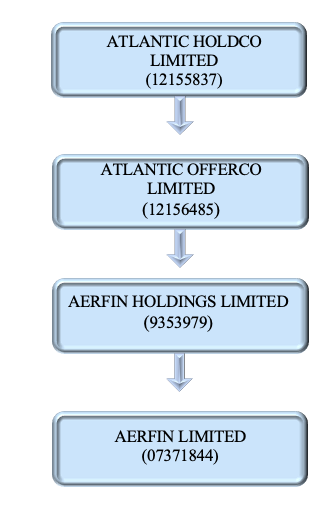

Aerfin Limited is owned by a large chain of companies presented below through a relevant diagram indicating the control hierarchy:

Below the analytical shareholding structure of Atlantic Holdco Limited is cited to indicate Aerfin’s key decision-makers:

• Statement of Capital (Share Capital)

Class of Shares: ORDINARY C

Currency: USD

Number Allotted: 6574795

Aggregate nominal value: 657479.5

Prescribed Particulars:

(A)The ORDINARY C shares have no voting rights. (B) Each ORDINARY C share is entitled to dividend payments in the amount specified in the Article 4 of the Articles of Association of the company. (C) Each ORDINARY C share is entitled to participate in a distribution arising from a winding up of the company in the amount specified in Article 5 of the company’s Articles of Association. (D) The ORDINARY C shares are not redeemable.

• Statement of Capital (Share Capital)

Class of Shares: A1 ORDINARY

Currency: USD

Number Allotted: 32889631

Aggregate nominal value: 32889631

Prescribed Particulars:

(A)On a show of hands every member shall have one vote and on a poll every member shall have one vote for every A1 ORDINARY share of which he is the holder. (B) Each A1 ORDINARY share is entitled to dividend payments in the amount specified in the Article 4 of the Articles of Association of the company. (C) Each A1 ORDINARY share is entitled to participate in a distribution arising from a winding up of the company in the amount specified in Article 5 of the company’s Articles of Association. (D) The A1 ORDINARY shares are not redeemable.

• Statement of Capital (Share Capital)

Class of Shares: A2 ORDINARY

Currency: USD

Number Allotted: 370

Aggregate nominal value: 370

Prescribed Particulars:

(A) On a show of hands every member shall have one vote and on a poll every member shall have one vote for every A2 ORDINARY share of which he is the holder. (B) Each A2 ORDINARY share is entitled to dividend payments in the amount specified in the Article 4 of the Articles of Association of the company. (C) Each A2 ORDINARY share is entitled to participate in a distribution arising from a winding up of the company in the amount specified in Article 5 of the company’s Articles of Association. (D) The A2 ORDINARY shares are not redeemable.

• Statement of Capital (Share Capital)

Class of Shares: A3 ORDINARY

Currency: USD

Number Allotted: 17710000

Aggregate nominal value: 17710000

Prescribed Particulars:

(A) On a show of hands every member shall have one vote and on a poll every member shall have one vote for every A3 ORDINARY share of which he is the holder. (B) Each A3 ORDINARY share is entitled to dividend payments in the amount specified in the Article 4 of the Articles of Association of the company. (C) Each A3 ORDINARY share is entitled to participate in a distribution arising from a winding up of the company in the amount specified in Article 5 of the company’s Articles of Association. (D) The A3 ORDINARY shares are not redeemable.

• Statement of Capital (Share Capital)

Class of Shares: B1 ORDINARY

Currency: USD

Number Allotted: 6900000

Aggregate nominal value: 6900000

Prescribed Particulars:

(A) On a show of hands every member shall have one vote and on a poll every member shall have one vote for every B1 ORDINARY share of which he is the holder. (B) Each B1 ORDINARY share is entitled to dividend payments in the amount specified in the Article 4 of the Articles of Association of the company. (C) Each A1 ORDINARY share is entitled to participate in a distribution arising from a winding up of the company in the amount specified in Article 5 of the company’s Articles of Association. (D) The B1 ORDINARY shares are not redeemable.

• Statement of Capital (Share Capital)

Class of Shares: B2 ORDINARY

Currency: USD

Number Allotted: 1630345

Aggregate nominal value: 1630345

Prescribed Particulars:

(A)The B2 ORDINARY shares have no voting rights. (B) Each B2 ORDINARY share is entitled to dividend payments in the amount specified in the Article 4 of the Articles of Association of the company. (C) Each B2 ORDINARY share is entitled to participate in a distribution arising from a winding up of the company in the amount specified in Article 5 of the company’s Articles of Association. (D) The B2 ORDINARY shares are not redeemable.

• Statement of Capital (Total)

Currency: USD

Total Number of shares: 65705141

Total Aggregate nominal value: 59787825.5

• Full Details of Shareholders

As per the Statement of capital above, the key shareholders are the ones holding A1, A2, A3 & B1 shares since they are entitled voting rights. Based on this fact, the following shareholders presented to have decision-making control (the numbering is in accord with the relevant file):

Shareholding 2: 31215753 A1 ORDINARY shares held as at the date of this confirmation statement (13/08/2020)

Name: CATACAP II K/S

Shareholding 4: 1673878 A1 ORDINARY shares held as at the date of this confirmation statement (13/08/2020)

Name: CC II MANAGEMENT INVEST II K/S

Shareholding 5: 370 A2 ORDINARY shares held as at the date of this confirmation statement (13/08/2020)

Name: CC II MANAGEMENT INVEST II K/S

Note: CataCap holds 50.05% of the company’s shares.

Shareholding 6: 3010700 A3 ORDINARY shares held as at the date of this confirmation statement (13/08/2020)

Name: GREP IV L.P.

Shareholding 7: 9917600 A3 ORDINARY shares held as at the date of this confirmation statement (13/08/2020)

Name: SCHRODER ADVEQ EUROPE DIRECT II S.C.S (Luxembourg registered)

Website: https://www.schroderadveq.com/site/

Shareholding 8: 4781700 A3 ORDINARY shares held as at the date of this confirmation statement (13/08/2020)

Name: TMC III L.P. (Reg. No.: SL030180-owned by London Pensions Fund Authority)

Shareholding 9: 6900000 B1 ORDINARY shares held as at the date of this confirmation statement (13/08/2020)

Name: ROBERT JOHN JAMES

What is the prospect’s strategy and ambitions?

Strategy

Geographical Expansion & Market Share Increase: The growth in the Aerfin brand during the financial year 2019, resulted in an increase in market presence with the company servicing over 440 customers in 66 countries.

Focus on narrow-body jet rather widebody long-haul aircraft:

Aerfin has benefitted through its primary strategic focus and inventory holding that supports young narrow-body and regional jet aircraft types. The company has further benefitted through having no dependency on revenues from widebody long-haul aircraft that continue to experience significant levels of grounding and which have suffered from low market demand.

Contractual Arrangements of lower cost:

The business has also taken the opportunity to secure additional long-term revenue contracts as many operators have sought to minimise their costs and review pre-existing contractual arrangements

Cost-Focused & Differentiation Strategy: They state they provide cost-saving aftermarket support solutions to the aviation industry. Led by an experienced team of aviation experts, they offer completely bespoke services ranging from whole aircraft and engine sale or lease, through to tailored flight-hour component support solutions.

Defined Contribution Pension Plan for Employees

COVID-19 Risk Management:

The aviation industry has been significantly impacted by the Covid-19 pandemic, with more than 3 quarters of the global commercial aircraft fleet grounded in the second quarter of 2020 as many countries closed borders to stop the spread of the virus. The business has managed to retain a large proportion of revenues, due to a strong committed forward order book, when the pandemic set in, embedded relations with creditworthy customers, supply to cargo operators and wide global reach allowing continuity of trade with regions less affected by the pandemic.

Brexit Risk Management:

The UK has now left the “Single Market” facilitating the free movement of goods within the EU. Aerfin believed that Aviation parts will continue to attract low levels of duty as the industry is reliant on a global supply chain to keep aircraft in service. Protectionism would be counter-productive for the industry. To combat this, AerFin is applying for Authorised Economic Operator Status and for a licence to operate a Customs Warehouse. AerFin is also planning on creating a pool of parts based on the continent for this period to ensure that their customers have continued access to their products throughout the transition period.

Ambitions

Further Geographical Expansion & Market Share Increase:

In October 2019 private equity firm CataCap became the majority shareholder in AerFin Holdings Ltd. Together with Founder & CEO Bob James and the management team, CataCap will strengthen the business and make it ready for further international expansion.

Who are the prospect's customers?

Their customers range from established legacy airlines through to start-ups, regional operators, Investment Firms, Asset Management Companies and Lessors

Customer Examples:

KLM

• CEO & President: Pieter Elbers

• UK MD in the Engineering Division: Peter van der Horst

SR Technics

• Group CEO: Jean-Marc Lenz

• Head of Human Resources UK: Sarah Penn

Customer Reviews on their website:

BA CityFlyer Head of Fleet & Airworthiness

“The selection of AerFin as our preferred pool partner for our E-Jet fleet reflects a very rigorous evaluation across the range of … namely quality and reliability of service and support combined with a competitive price solution.”

Hi Fly President and CEO

“This is the second engine Hi Fly have purchased from AerFin … It represents a cost-effective option to the traditional overhaul of the engines and we very much look to expand our commercial relationship with AerFin.”

President and Chief Executive Officer of GE Aviation’s Services

“Aviation has extensive component repair capabilities, and we continually invest in new repair techniques to help out customers. This agreement will bring our component repair offering to AerFin’s customers for their CFM56, CF34 and CF6-80C engines.”

CCO of SR Technics

“We are very pleased to be partnering with AerFin to supporting our long-standing customer Philippine Airlines. Beyond. Fleet. Services is an integrated solution designed to provide tailored support at each stage of aircraft maturity helping Philippine Airlines in optimizing their operational costs and fleet lifespan.”

Manager Purchasing – Aircraft Trading at Cathay Pacific

“Cathay Pacific selected AerFin after a comprehensive market review and has full confidence in their ability to deliver out material requirements.”

What does the prospect consider important for its customers?

- They solve even their customers’ most complex issues through the provision of world-class aftermarket solutions

- They go beyond their customers’ expectations

- They have reputation of delivering honest services to their customers

- They behave with the highest levels of integrity

- They deliver innovative solutions that are completely bespoke to each of their requirements

- They provide AOG Support

- They provide Inventory Purchasing & Services

- They provide Excess Stock Disposal

- Their engine exchange programs help customers avoid expensive Engine Shop Visits, as well as heavy investment in Life Limited Parts (LLPs), through immediately providing serviceable whole engines on green-time lease or outright exchange for unserviceable units.

- Their services are provided at a price-point that ensures significant operational cost savings

- Their Beyond Pool programme ensures that customers avoid large-scale initial investments whilst maintaining guaranteed, reliable access to stock. This gives customers reassurance that no matter the situation, they will have a dependable partner that allows them to focus on their other core business activities

- AerFin supports customer’s commercial fleet type with a fully integrated flight-hour agreement service that provides certainty of cost

- Their strategic inventory stocks are located worldwide to support their customers immediate requirements

Who are the prospect's staff?

The average monthly number of persons (including directors) employed by the group and company during 2019, amounted to113 (2018:101)

Employee Reviews

N/A

What are the prospect’s unique selling points (USPs)?

• Owned by a financially strong and reputable private equity firm

• Many years of experience in the field

• All-inclusive service packages

• Customisable solutions

• Their in-house capability means that they excel at executing larger, more complex or sophisticated contracts to buy fleet or deliver solutions

• They are able to effectively analyse engine and component conditions, through practising rigorous engineering due-diligence. This means that they are able to reduce the cost of operations whilst guaranteeing the technical and commercial integrity of the asset

• They ensure product safety remains a priority throughout every aspect of our operations and that staff are acutely aware of their contribution to this

• They are trusted by MROs and OEMs as a reliable, cost-efficient supplier that can guarantee the provision of high-quality material to meet airline operators planned and unplanned maintenance, repair and overhaul requirements

What are the prospect’s business activities and potentials?

The principal activity of the company is to supply aircraft components and technical services to the aviation industry.

Locations

Headquarters-Cardiff, UK

Unit D, Parc Bedwas

2 Greenway

Bedwas House Industrial Estate

Caerphilly

CF83 8DW

United Kingdom

London Gatwick – Components & AOG

Newton Road

Crawley

West Sussex

RH10 9TS

United Kingdom

Atlanta – E-jet Inventory Facility

Latin America – Offices

Singapore – Warehouse & Storage

Social Media

Published articles and awards

• “AerFin purchased by Denmark’s CataCap”, LARA News, Sept.2019

Awards on their website:

• Board Trade Award winner /2018

• The FT 1000 Fastest-growing Aerospace & Defence company in Europe/2017

• Fast Growth 50/2016-2018

• The Sunday Times Virgin Fast Track 100 fastest-growing firm in the UK/2017

Who are the prospect’s competitors?

Competitors List (alphabetical order)

Criterion: Industry subcategory, Company Size and Product

Apple Aviation Ltd (formerly STS Aviation Services UK)

Employee Count: 501-1,000 (based on their LinkedIn Profile, section “About”)

Engine Lease Finance (based in Ireland but they also have a department in London)

Employee Count: 51-200 (based on their LinkedIn Profile, section “About”)