- In the last two weeks, 10% of businesses currently trading reported the price of goods or services sold increased more than regular price fluctuations, with the manufacturing industry, the wholesale and retail trade; repair of motor vehicles and motorcycles industry, and the other service activities industry reporting the highest proportions at 25%, 23% and 21% respectively. (ONS, 2021)[1]

- According to HM Treasury, the £1.5bn rates relief fund announced earlier this year will cover the wholesale sector. The Government is currently preparing the guidance for local authorities on distributing the Covid-19 Additional Relief Fund (CARF).

- Budget announcement

In last month’s Budget, the Chancellor announced a 50 per cent business rates relief discount in 2022-23, with a cap of £110,000 per business.

Guidance has been updated to provide further clarity for staff in indoor settings in England. The latest guidance from Defra on face coverings in wholesale settings in England is:

- Staff in warehouses and distribution facilities are not required to wear a face covering during their work

- If staff are serving or coming into contact with visitors, they should wear a face covering

- Visitors need to wear a face covering when visiting warehouses/distribution facilities

- For other indoor settings, employers should assess the use of face coverings on a case-by-case basis depending on the workplace environment, other appropriate mitigations they have put in place, and whether reasonable exemptions apply. (Federation of Wholesale Distributors, 2021)

Digital skill is one critical area where there’s just not enough talent. 75% of business executives say they’ve had trouble recruiting staff with digital skills. Only 12% believe the nation’s graduates have the right digital skills to work in the modern age.

But even warehouse staff are proving hard to come by in some areas. There’s been as much as a 30% spike in pay for staff in the UK’s warehouses to try and attract new people. The CEO of the UK Warehousing Association claims the nation is still ‘tens of thousands’ of people short. (Unleashed, 2021)

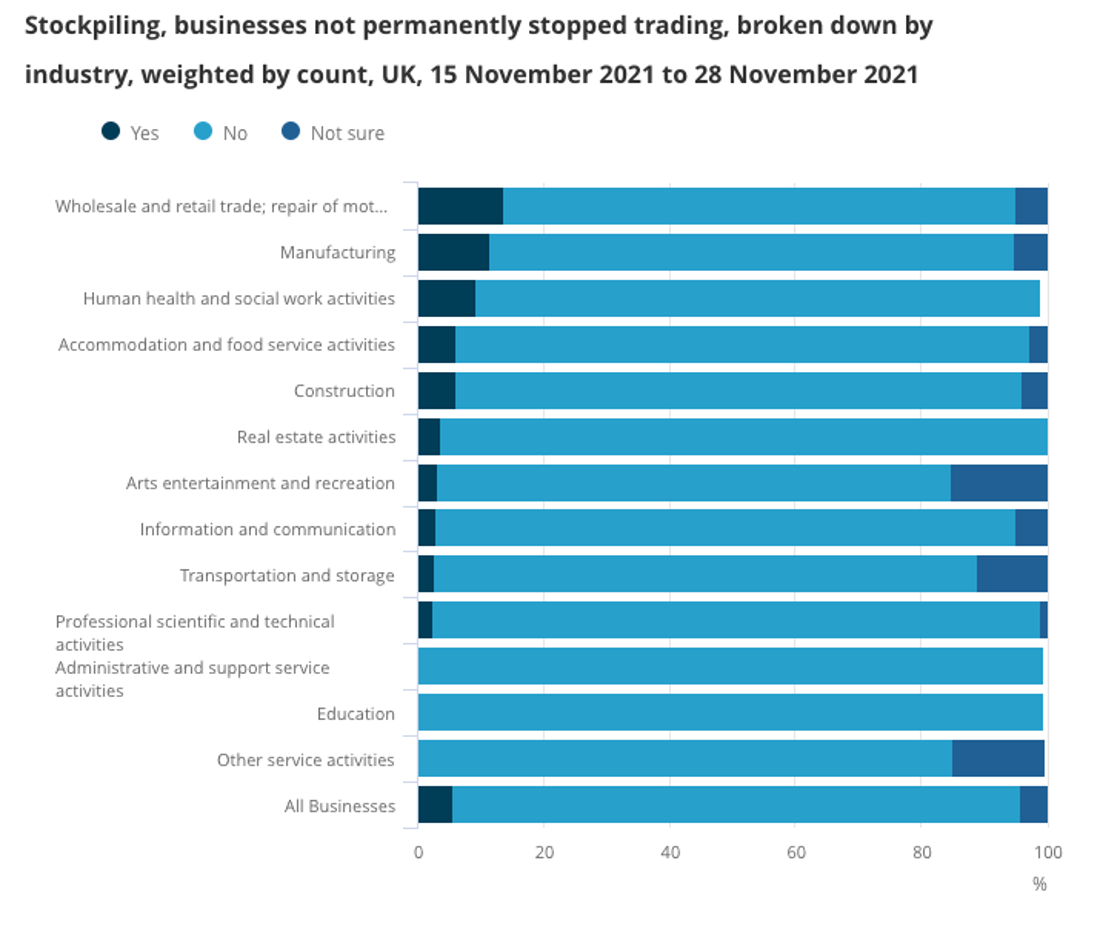

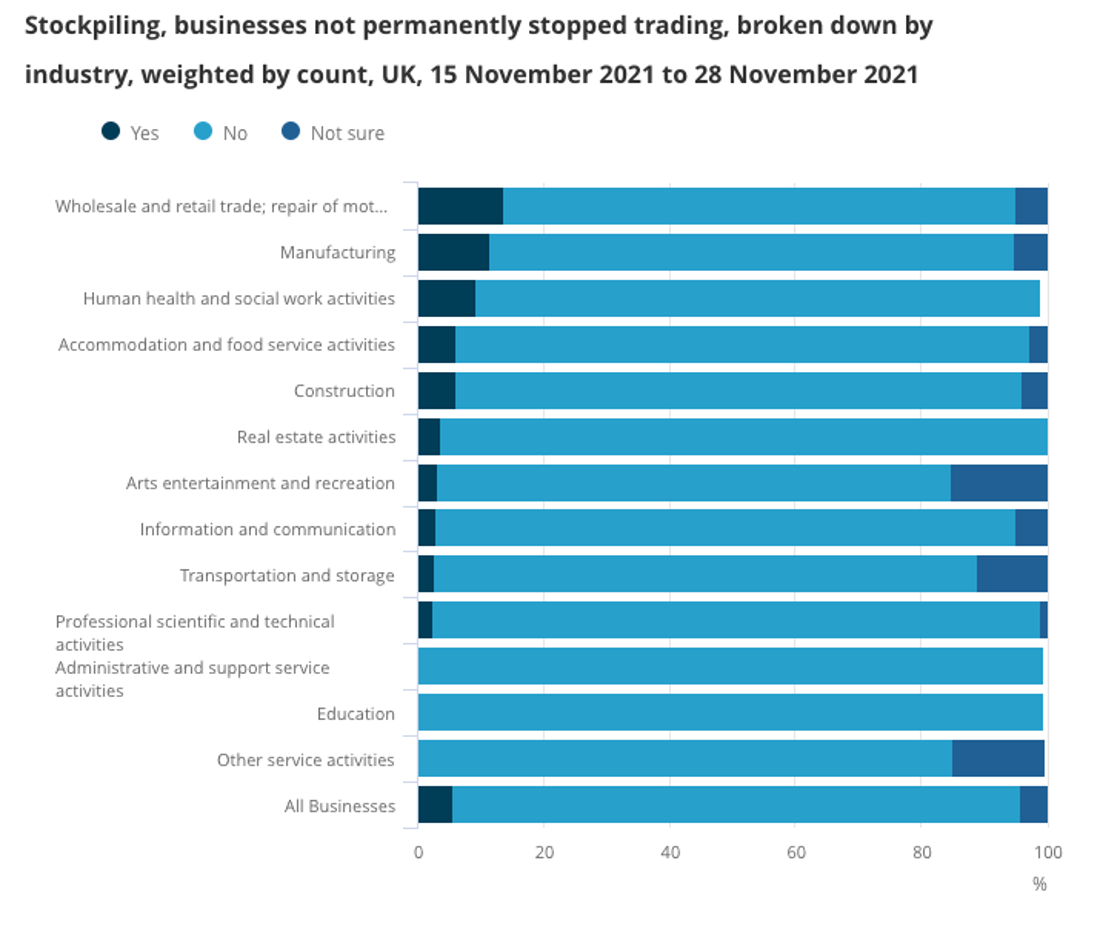

- 6% of businesses reported stockpiling goods or materials, with the wholesale and retail trade industry reporting the highest percentage.

(ONS, 2021)[1]

Clothing and Footwear Wholesaling

- The Office for National Statistics (ONS) reported clothing store volume sales declining by 22.2% over 2020. Government restrictions on non-essential stores, hospitality and social gatherings led to a significant decline in demand. This drove a large decrease in the wholesale of clothing and footwear in 2020-21 revenue, which is projected to have contracted by 27.7% in 2020-21.

- Online retailers are expected to become the dominant market for clothing and footwear wholesalers in the current year. The ONS reported the total value of online retailing growing by 46.1% over 2020, representing significant growth in this market.

- Supply chains have faced significant disruption, especially in sourcing products and materials from abroad. Quarantines, travel restrictions and disruptions to the supply of raw materials are damaging clothing supply chains across the globe.

- Over the five years through 2021-22, IBIS World expects industry revenue to decline at a compound annual rate of 3.7%. The outbreak of the COVID-19 (coronavirus) pandemic led to government restrictions on non-essential retail outlets and the hospitality sector, which encourages downstream demand through social interaction. Revenue plummeted over 2020-21 as a result. Furthermore, rising unemployment and falling disposable incomes have reduced demand for discretionary products, albeit to a limited degree, as industry revenue is expected to recover in the current year. This recovery is bolstered by strong demand through online retailers and a resurgence in confidence as the UK vaccination programme continues to be rolled out. (IBIS World, 2021)[2]

Grocery Wholesaling

- Heightened competition in industry markets and rising demand for groceries has somewhat relieved wholesalers of downstream pressures, driving growth in revenue and profit margins.

- Wholesalers affected by government restrictions during the pandemic gained access to discretionary local authority grants in October 2020. However, no sector-specific support was announced in the March 2021 budget, meaning wholesalers will have to compete among other businesses to access a share of the £425 million restart grant fund.

- Wholesalers have looked to consolidate within the supply chain to support their operations which government restrictions have disrupted. Bestway’s acquisition of Costcutter was confirmed in February 2021 and is expected to drive greater concentration in the industry.

- Over the five years through 2021-22, industry revenue is expected to grow at a compound annual rate of 0.3% to £45.8 billion. Grocery wholesalers have endured challenging operating conditions over the past five years. Pricing competition from supermarkets has led to these retail giants using their market dominance to negotiate better prices, constraining revenue and narrowing profit margins. An increase in food crimes reported to the National Food Crime Unit has raised the demand for better knowledge of the provenance of products, which has intensified wholesale bypass activity, with increasing health consciousness playing a vital role in this trend. (IBIS World, 2021)[3]