Target status: x

Upload date: 21/10/2019

Last updated on: 26/11/2020

Who are the important people in the company?

• Simon James Blouet Shaw

Correspondence address: 33 Margaret Street, London, W1G 0JD

Date of birth: February 1965

Nationality: British

Country of residence: England

Occupation: Group Chief Financial Officer

• Mark Ridley

Correspondence address: 33 Margaret Street, London, W1G 0JD

Date of birth: March 1962

Nationality: British

Country of residence: England

Occupation: Group Chief Executive Officer

Non-Executive Directors

• Nicholas Eustace Haddon Ferguson

Correspondence address: 33 Margaret Street, London, W1G 0JD

Date of birth: October 1948

Nationality: British

Country of residence: United Kingdom

Occupation: Chairman of Savills Plc and Chairman of the Nomination & Governance Committee

• Stacey Cartwright

Correspondence address: 33 Margaret Street, London, United Kingdom, W1G 0JD

Date of birth: November 1963

Nationality: British

Country of residence: England

Occupation: Independent Non-Executive Director and Chair of the Audit Committee

• Rupert Hugo Wynne Robson

Correspondence address: 33 Margaret Street, London, United Kingdom, W1G 0JD

Date of birth: February 1961

Nationality: British

Country of residence: England

Occupation: Independent Non-Executive Director and Chair of the Remuneration Committee

What is the structure of the company?

• Statement of Capital (Share Capital) (08/09/20)

Class of Shares: ORDINARY

Currency: GBP

Number Allotted: 143063347

Aggregate nominal value: 3576583.68

Amount paid per share: 0.025

Prescribed Particulars:

Each share is entitled PARI PASSU to dividend payments or any other distribution-this will reflect a basic right to dividends but any dividend must be made in accordance with the companies act and the company’s articles of association; each share is entitled to PARI PASSU to participate in a distribution arising from a winding up of the company in accordance with the law.

• Statement of Capital (Total) (08/09/20)

Currency: GBP

Total Number of shares: 143063347

Total Aggregate nominal value: 3576583.68

Total Aggregate amount unpaid: 0

• Full List of Shareholders

Due to the large chain of institutional shareholders of Savills Plc multiple sources were utilised to reach the closest estimation to the current Group structure and detect the majority of the Group’s key decision makers.

The data showed below are combinational relied on the following sources:

Marker Screener (Nov.2020):

https://www.marketscreener.com/quote/stock/SAVILLS-PLC-4006034/company/

Financial Times (Oct.2020)

https://markets.ft.com/data/equities/tearsheet/profile?s=SVS:LSE

Morning Star (2020)

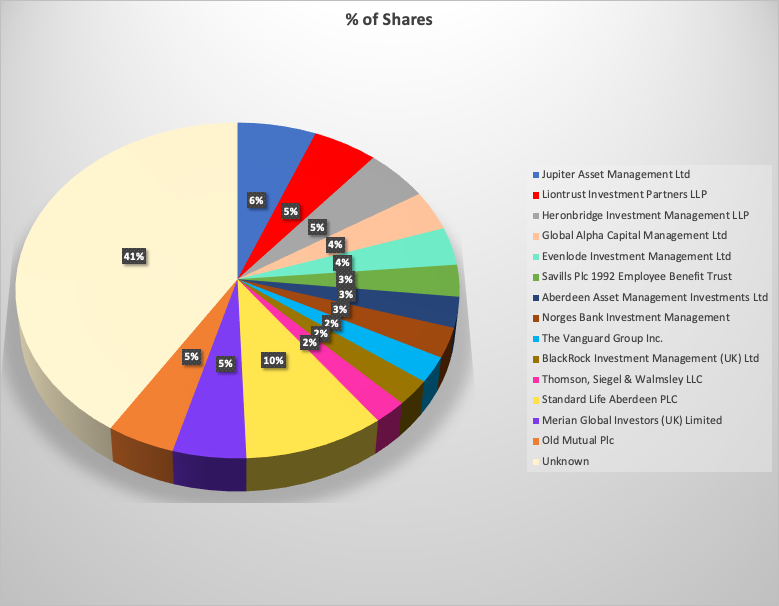

The pie-chart above presents the % of shareholding rounded without decimals in order to give a broader image of the Group’s structure. All the institutional shareholder’s count for 59,09% of Savills allotted shares

Aggregate Shareholding Earnings based on their Annual Report (Dec.2019):

- Dividends: 32.0 p

- Underlying profit: £ 143.4 m

- Underlying earnings per share: 78.0 p

Key People per Institutional Shareholder:

Jupiter Asset Management & Merian Global Investors (UK) Limited (11.13%)

Merian is a subsidiary of Jupiter.

- CEO: Andrew James Formica

- CFO: Wayne Mepham

- CEO: John lons

- COO & CFO: Vinay Abrol

Heronbridge Investment Management LLP

- CEO: Benoit Bouchaud

- Partner: Tom Day

Global Alpha Capital Management

- Chief Investment Officer: Robert Beauregard

Evenlode Investment Management Ltd

- Fund Manager & Chief Investment Officer: Hugh Yarrow

Aberdeen Asset Management Investments Ltd

- Non-Executive Chairman: Keith Skeoch

- Global COO: Mike Tumilty

Norges Bank Investment Management

- CEO: Nicolai Tangen

- CEO: Tim Buckley

BlackRock Investment Management (UK) Ltd

- CFO: Colin Thomson

Thomson, Siegel & Walmsley LLC

- President: John L. Reifsnider

- CFO: Joseph VanCaster

- CEO: Stephen Bird

- Group CEO: Iain Williamson

What is the prospect’s strategy and ambitions?

Strategy

- Savills strategy is to be a leading advisor in the key markets in which they operate

- Their global strategy is delivered locally by their experts on the ground with the flexibility to adapt quickly to changes in circumstances and opportunities

Investment in Emerging Technology

Emerging technology continues to be a focal area in the real estate industry and also for their business. They have continued to invest in their own technology platform in order both to deliver innovative solutions to their clients through data analysis and insight and to drive internal efficiencies

Geographical & Intersectoral Expansion through Acquisition

Based on their Annual Report published in Dec.2019, Savills Investment Management acquired a newly constructed prime Grade A distribution centre in Greater Paris, France for EUR 83.8 million on behalf of its European Logistics Fund.

Geographic Diversification to eliminate Economic Volatility Risk

Their strategy of diversifying their service offering and geographic spread mitigates the impact on the business of economic downturns and weak market conditions in specific geographies, but these factors cannot entirely mitigate overall risk to earnings. To manage these risks, they maintain a continuous focus on their cost base and seek to improve operational efficiencies.

Recruitment and Retention of high-calibre staff:

They recognise that the future of their business is dependent on attracting, developing, motivating and retaining people of the highest quality. For this reason, they continue to invest in their training and development programmes across the businesses.

Their partnership style culture and profit-sharing approach to remuneration is combined with selective use of share-based and other rewards to incentivise and retain their best people for the long-term benefit of the Group.

Employee Engagement (as written in the Annual Report)

They continue to focus on employee engagement through a number of areas of focus. For example, in the UK they are improving the capability of their leaders and managers through their key programmes Empower, Engage and Inspire. They have improved the clarity of their reward and benefits through the use of a new Total Reward Statement so that all their employees clearly see the full reward package. They take employee wellbeing seriously and have an established wellbeing programme and they are committed to the Time to Change pledge.

Developing Talent

They deliver training and development in all areas including management and leadership, client and business skills and professional and technical skills. For example, in the UK, the format of their training varies from one-hour masterclasses, webinars, and video content, to two-day pitching courses and management and leadership workshops. In order to manage individual development and ongoing learning, they have launched a learning Management System (LMS) in the UK. The LMS is mobile compatible, allows individuals to track and manage their development, watch video podcasts and download course materials.

Employee Benefit Trust and Savills Rabbi Trust

The company has established the Savills plc 1992 Employee Benefit Trust (the EBT) and the Savills Rabbi Trust, the purposes of which are to grant awards to employees, to acquire shares in the Company pursuant to the Savills Deferred Share Bonus Plan and the Savills Deferred Share Plan and to hold shares on the Company for subsequent transfer to employees on the vesting of the awards granted under the schemes.

Pensions Obligations

The group operates both defined benefit and defined contribution plans

COVID-19

They are closely monitoring the short and medium-term impacts of the pandemic. The welfare of their staff and clients is paramount and they have implemented risk management measures consistent with governmental guidance. In addition, they have business continuity in crisis plans in order to respond quickly to mitigate the impact. Any longer-term impacts will also be considered and monitored, as appropriate.

Their Vision

- To advise private, institutional and corporate clients seeking to acquire, manage, lease, develop or realise the value of prime residential and commercial property in the world’s key locations

Who are the prospect's customers?

- Private, institutional and corporate clients

- Residential, commercial and rural properties for sale or rent

Customer Reviews on Trustpilot:

“Blatant disregard for covid restrictions

I was a tenant in a house that Savills were selling. Multiple members of the household were quarantining after a trip abroad, which Savills were well aware of, but they still brought elderly and vulnerable prospective buyers around to view the property. Not only was this a blatant disregard of the government restrictions, but also of the safety of the prospective buyers.”

Alex-Nov.2020

“Ealing – Residential Letting – Poor Customer Service

We have experienced terrible customer service, with this branch over the past few months, in relation to renting a property in the area.

After providing all relevant information quickly, and further explanation regarding circumstances and the purpose of our move, a seemingly disinterested employee promised to respond once a dialogue had been established with the landlord on a property Savills managed on their behalf.

An offer was made and rejected, with very little explanation. Especially, when the main reason for not taking the process further was based on the offer being too low. This became seemingly redundant based on the email received by my partner stating that the offer we gave, only a few weeks before, was now the asking price. In our opinion this created a very distrustful image of the company, and it’s processes further reinforced by the fact they sent the email to my partner and not me.

I rang and emailed again to follow up on the reduction, only to be met with further promises that I would get more information once the landlord has been spoken to, which had been promised to be the next day. It has now been a week without any further information. All information we have provided has been swift and all evidence shows us to be reliable tenants, given the rent we currently pay is far more than the current asking price. There seems to be no logical reason for this poor transparency and we would appreciate a more direct and honest response from Savills if they value customer feedback.

The only redeeming aspect of this branch currently presides with a Residential Letting negotiator, who has been very communicative and helpful, but sadly this is not a redeeming quality for any further interacting with the branch or company in the future.”

Samuel D.-Oct.2020

What does the prospect consider important for its customers?

• They continue to invest in the development of client relationships globally and associated systems/digital technology to support, enhance and extend their client service offering

• Their businesses are in continuous contact with their clients, to understand their requirements, to listen to their feedback and their service levels and to understand their expectations in terms of the development of their service offering.

• As part of their the client relationship management programme, it is the responsibility of their dedicated client relationship leads to gain a deep understanding of their clients’ businesses through regular dialogue and share this knowledge with the wider client relationship and business leadership teams.

Who are the prospect's staff?

The average monthly number of persons (including directors) employed by the group and company during 2018, amounted to 6,088 (2017:5,687)

2018

Group Employees: 5,955

Company: 133

Employee Reviews on Glassdoor:

Overall Rating: 3.7/5 (485 Reviews)

Analytical Rating:

- Culture & Values: 3.5/5

- Diversity & Inclusion: 2.9/5

- Work-life Balance: 3.4/5

- Senior Management: 3.4/5

- Compensation & Benefits: 3.3/5

- Career Opportunities: 3.6/5

Former Employee – Graduate Surveyor in Peterborough, England-Oct.2020 (1/5)

I worked at Savills full-time for more than a year

Pros

Fantastic APC support

Meet wonderful colleagues and friends from across the country

Great networking opportunities and London visits

Cons

Unapproachable Head of Office

Poor line manager with complete lack of social skills who treated me like admin support and was not interested in my learning or development

Unequal pay between males and females

Sexism rife in the workplace and complaints fell on deaf ears

Many fee earners treat those is administrative roles very poorly and like second class citizens

Advice to Management

Be kind and be fair. Support women in the workforce, rather than like a token seat at a table.

What are the prospect’s unique selling points (USPs)?

• They are a global real estate services provider with over 600 offices worldwide. Savills.co.uk regularly attracts visits from more than 220 territories around the world, giving your property access to more buyers, and more opportunities to sell

• Over 35,000 experts worldwide

• Over 200 expert researches and 300 services to fulfil their client’s needs

• 160 years of experience

• Most visited website: with over 1.8 million visits per month* savills.co.uk is the most visited UK national estate agency website, based on a custom category of national estate agency websites

What are the prospect’s business activities and potentials?

Savills is a leading commercial, residential and rural real estate service provider. Established in 1855, with over 600 offices and associates around the world.

More analytically their services include:

• Transaction Advisory

• Property & Facilities Management

• Consultancy

• Investment Management

Locations

135 offices in the United Kingdom and over 650 offices across the Americas, Europe, Asia Pacific, Africa and the Middle East

Head Office London

33 Margaret Street,

London

W1G 0JD

+44 (0) 20 7499 8644

Social Media

Who are the prospect’s competitors?

Competitors List

Criterion: Demographic criteria

Countrywide Plc

Employee Count: 10,001+ based on their LinkedIn profile, section “About”

Foxtons Limited (part of Foxtons Group Plc)

Employee Count:1,063:2019

Purplebricks Group Plc

Employee Count: 914:2020

How helpful was this profiling? Help us improve by rating!

(1 star=Not helpful, 2 stars= Slightly helpful, 3 stars= Moderately helpful, 4 stars=Very helpful, 5 stars=Extremely helpful)